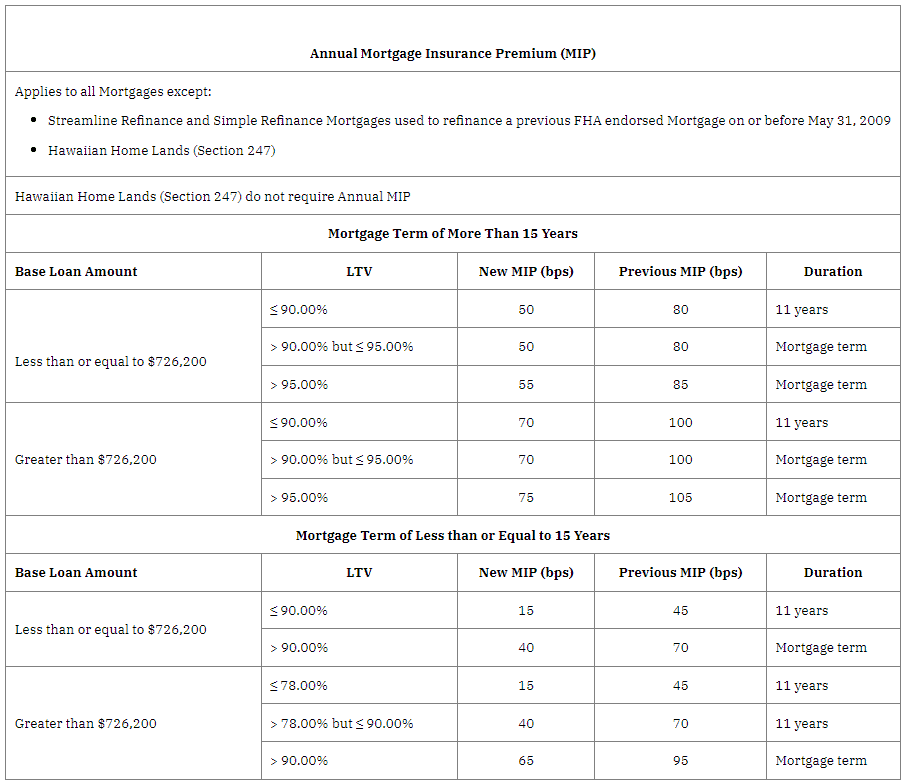

Effective March 20, 2023, The annual mortgage insurance premiums (MIP) will be reduced from 0.85% to 0.55%, for all mortgages closed on or after March 20th. The announcement was made by (HUD) due to the FHA’s mortgage insurance fund having more than five times Congress’ required reserves.

They figured this money could be put to good use helping the American people. On average, 850,000 homebuyers and homeowners nationwide will see their housing costs decrease by $800 in 2023 due to this reduction in MIP rates. HUD made the announcement on February 22nd, 2023.

Under current FHA guidelines, Buyers pay an upfront mortgage insurance cost of 1.75%, that is usually financed into the mortgage plus an annual rate of 0.85%, which is added to their monthly payment. Some call this PMI (PMI is for Conventional Loans, MIP is for FHA Insurance Mortgages). With the reduction in this rate, those with new FHA mortgages will only have to cover 0.55% annually in mortgage insurance costs. For example, on a $400,000 loan, this could mean a savings of $100/mo on your monthly mortgage statement.

FHA Commissioner Julia Gordon stressed the significance of this initiative, noting its long-overdue arrival and providing crucial relief to homeowners, especially given the steep rise in mortgage rates and home prices recently. She said that by reducing MIP for qualified FHA borrowers, mortgage payments would be lower for them – thus making homeownership more accessible to more people.

Industry thoughts on MIP Reduction

The Mortgage Bankers Association applauded the news, noting that it will give an opportunity and chance at homeownership for more first time and minority homebuyers, as well as low to moderate-income households. They stated that this premifum reduction would benefit qualified borrowers by relieving them of current mortgage rate increases and home prices just in time for the spring buying season. this change truly effects and benefits middle class Americans.

The Community Home Lenders Association (CHLA), representing smaller mortgage lenders, also appreciated the Biden administration’s cut to premiums. Executive Director Scott Olson stated that an FHA premium cut is necessary to guarantee affordable access to mortgage credit for minorities and other underserved borrowers, particularly in light of rising mortgage rates and outstanding homeownership affordability issues.

Some mortgage analysts, however, anticipate no significant effects from the premium cut on the mortgage market. Bose George, from KBW noted in the housing Wire that such an amount would have minimal influence on shifting share away from mortgage insurance companies to the FHA. Furthermore, this decrease in MIP will offset any reductions to GSE fees for higher-risk borrowers, which might have shifted some volume away from FHA to mortgage insurers otherwise.

Summary

In summary, this decrease in annual mortgage insurance premiums is a historic development for the mortgage industry, gives bi-partisan support for the Biden Administration and offers needed relief to homebuyers. MIPs will enable more people to access affordable homeownership opportunities, particularly those underserved by traditional lending practices.

As mortgage lenders, we are delighted by this news and eager to assist qualified borrowers in taking advantage of this reduced MIP rate. We agree with Commissioner Gordon that this move has been long overdue and will make a real difference for borrowers while expanding access to affordable homeownership opportunities.

Fill out an inquiry on the right to see how much we can save you when applying for an FHA loan with South Texas Lending!