Your down payment isn’t the only thing you need to worry about when finalizing your home purchase in Texas. You need to be aware of how much you actually need to bring to the closing table — and these include closing costs.

Closing costs are fees and expenses you pay on the day you close your mortgage loan. These fees could cover everything from loan origination fees to title insurance. Typically you should prepare to pay between 2% and 5% of your loan amount.

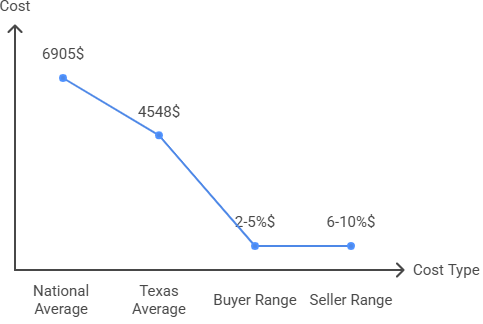

When you’re buying a home in Texas, for instance, the closing costs average $4,548. These higher-than-national-average costs were due to two factors: property taxes and insurance requirements. However, Texas offers benefits like no state transfer taxes and seller-paid customary fees that can offer ways to reduce your closing costs.

What Are Closing Costs?

Closing costs are fees you need to pay on your closing date to transfer home ownership and secure financing. These expenses cover services necessary to complete your home purchase and doesn’t include your home’s purchase price and down payment.

In Texas, closing costs include:

- origination fees

- appraisal fees

- title insurance

- property taxes

- various third-party services

If you’re serious about becoming a Texas homebuyer, it’s important not to underestimate the amount you need to pay on your closing date. Preparation is key.

How Much Are Closing Costs in Texas?

Average closing costs in Texas typically range from 2% to 5% of your loan amount. Though the specific costs you need to pay will depend on your lender, loan type, and property location. For example, on a $300,000 mortgage loan, you might pay between $6,000 and $15,000 in total closing costs.

Texas Closing Cost Breakdown:

- National average: $6,905 (with transfer taxes)

- Texas average: $4,548 (approximately 1.5% of median home price)

- Range: 2-5% of loan amount for buyers

- Seller costs: 6-10% of sale price (including real estate agent commissions)

What’s Included in Closing Costs: Complete Breakdown

Closing costs fall into three main categories: lender fees, third-party fees, and prepaid expenses. Each category serves a specific purpose in the home buying process.

Lender Fees and Loan Costs

Your mortgage lender will charge you these fees as a payment for loan processing and approval.

Loan Origination Fees Origination fees cover your lender’s administrative costs for creating your mortgage loan. These fees typically range from 0.5% to 1% of your total loan amount. On a $300,000 mortgage, expect to pay $1,500 to $3,000 in origination fees.

Underwriting Fee The underwriting fee covers the cost of reviewing and verifying your financial information for loan approval. This fee ranges from $300 to $800, depending on your lender and loan complexity.

Application Fee Some lenders charge an application fee to process your mortgage application, typically ranging from $100 to $500. This fee may be applied toward other closing costs or required separately.

Credit Report Fee Your lender pulls your credit report from all three major credit bureaus, costing approximately $25 to $50. Even if you’ve recently checked your credit, lenders require their own credit report for underwriting.

Discount Points Discount points are optional fees you can pay to reduce your interest rate. Each point costs 1% of your loan amount and typically reduces your rate by 0.25%. On a $300,000 loan, one point would cost $3,000.

Third-Party Fees and Services

These fees pay for services provided by companies other than your lender. These include:

Appraisal Fees Lenders require a professional appraisal to determine your home’s fair market value. Appraisal fees in Texas range from $400 to $700 for typical homes, though larger or unique properties may cost $800 to $1,000 or more.

Title Insurance and Title Search Title insurance protects you and your lender from title defects or ownership disputes. In Texas, title insurance rates are standardized by the Texas Department of Insurance.

- Lender’s title insurance: Required by your mortgage lender

- Owner’s title insurance: Protects you (often seller-paid in Texas)

- Title search fee: $300 to $600 to research property ownership history

Survey Fee A survey fee covers the cost of confirming your property boundaries and identifying any encroachments. Survey fees range from $376 to $768, depending on property size. In Texas, sellers customarily pay survey fees, benefiting buyers.

Home Inspection While optional, home inspections are recommended to identify potential issues. In Texas, home inspection costs range from $250 to $500, depending on your home’s size and complexity.

Attorney Fees Some states require attorneys for real estate closings, though Texas doesn’t mandate attorney involvement. If you choose to use an attorney, fees typically range from $500 to $1,500.

Recording Fee Recording fees, paid to your local government, update public property records to reflect your ownership. In Texas counties like Bexar County (San Antonio), recording fees typically cost $30 to $50 per document.

Prepaid Expenses and Escrow Items

These are ongoing homeownership costs paid upfront at closing. The fees cover:

Property Taxes You’ll pay prorated property taxes from your closing date through the end of the tax year, plus an escrow deposit of 2-3 months of estimated annual property taxes. Texas property taxes are higher than the national average, increasing your prepaid costs.

Homeowners Insurance Your first year’s homeowners insurance premium is due at closing, along with an escrow deposit of 2-3 additional months. Texas weather risks may increase insurance premiums compared to other states.

Private Mortgage Insurance (PMI) If your down payment is less than 20% on a conventional loan, you’ll pay private mortgage insurance. Your first month’s PMI premium may be due at closing, typically costing $30 to $70 monthly per $100,000 borrowed.

Prepaid Interest You’ll pay interest that accrues on your mortgage loan from your closing date until your first mortgage payment. This amount depends on your loan amount, interest rate, and closing date. Closing near month-end reduces prepaid interest charges.

Escrow Account Deposits Your lender may require an escrow account to collect funds for property taxes and homeowners insurance. Initial escrow deposits typically equal 2-3 months of these expenses.

Understanding Your Loan Estimate and Closing Disclosure

Your lender is legally required to explain and give you an outline of the closing costs and terms of the loan that you have applied for. These documents must include details such as:

Loan Estimate

Your lender should give you a loan estimate within three days of your mortgage application. The document details, which include loan terms and estimated closing costs, can make it easier to compare loans and lenders and choose the one that is right for you.

The Loan Estimate divides costs into sections:

- Loan Costs: Origination fees, appraisal fees, credit report fees

- Other Costs: Title insurance, prepaid expenses, government fees

- Services You Can Shop For: Title companies, attorneys, surveyors

Closing Disclosure

You’ll receive the closing disclosure at least three days before your scheduled closing. This details your final terms and costs. Compare this document to your original Loan Estimate to identify any changes in fees or loan terms.

Who Pays Closing Costs in Texas?

Both buyers and sellers pay closing costs, though the specific fees differ.

Here’s a breakdown.

Buyer Closing Costs

Buyers typically pay 2% to 5% of the purchase price in closing costs, including:

- All loan-related fees (origination, underwriting, appraisal)

- Lender’s title insurance

- Home inspection and pest inspection

- Credit report fee

- Recording fees

- Prepaid expenses (taxes, insurance, interest)

Seller Closing Costs

Sellers typically pay 6% to 10% of the sale price, including:

- Real estate agent commissions (traditionally both agents)

- Owner’s title insurance (customary in Texas)

- Survey fees (customary in Texas)

- Transfer fees and taxes

- Attorney fees (if applicable)

- Outstanding mortgage payoff

Seller Concessions

Buyers can negotiate for sellers to pay for some closing costs through seller concessions. The amount depends on your loan type:

- Conventional loans: Up to 3-6% of purchase price (depending on down payment)

- FHA loans: Up to 6% of purchase price

- VA loans: Up to 4% of purchase price

- USDA loans: Up to 6% of purchase price

Texas-Specific Closing Cost Advantages

Texas offers several advantages that can reduce your closing costs:

No State Transfer Taxes

Unlike many states, Texas doesn’t impose state transfer taxes on real estate transactions. This is good news if you’re a homebuyer as it can potentially save you thousand of dollars.

Seller-Paid Customary Fees

In Texas, sellers traditionally pay for:

- Owner’s title insurance policy

- Property survey fees

- Some transfer and recording fees

These customs reduce the buyer’s closing cost burden compared to other states.

Down Payment Assistance Programs

Texas Department of Housing and Community Affairs (TDHCA)

- My First Texas Home: Up to 5% of loan amount for down payment and closing costs

- My Choice Texas Home: Available to veterans and repeat buyers

San Antonio Local Programs

- HIP 80: $1,000-$30,000 assistance, fully forgiven over 5-10 years

- HIP 120: $1,000-$15,000 assistance, 75% forgiven over 10 years

How to Reduce Your Closing Costs

Several strategies can help minimize your closing costs:

Shop Around for Services

Compare fees among multiple lenders, as origination fees and other charges can vary significantly. This will help you choose loan estimates that matches your current situation. You can also see other options for:

- Title insurance companies

- Home inspectors

- Attorneys (if needed)

- Homeowners insurance

Negotiate with Your Lender

Many lender fees are negotiable, including:

- Origination fees

- Processing fees

- Underwriting fees

- Application fees

Time Your Closing Strategically

Closing near the end of the month reduces prepaid interest charges, as you’ll pay less interest from closing to your first mortgage payment.

Consider No-Closing-Cost Loans

Some lenders offer loans where closing costs are rolled into your loan amount. This means they can exchange the closing costs with a higher interest rate.

Use Assistance Programs

Research available programs in your area, including:

- First-time homebuyer programs

- State and local assistance programs

- Employer homebuying benefits

- Military programs (for VA loan eligibility)

Working with South Texas Lending

As your local San Antonio mortgage partner, South Texas Lending provides several advantages:

Local Market Expertise: We understand Texas closing customs and can guide you on negotiable versus fixed costs.

Competitive Rates: Our rate guarantee ensures you receive the most competitive terms available.

Fast Processing: Local underwriting and processing provide more control over your closing timeline.

24/7 Availability: Get answers when you need them, including evenings and weekends.

Frequently Asked Questions

Are closing costs higher in Texas?

Texas closing costs are generally higher than the national average due to property taxes and insurance requirements. However, Texas homebuyers can take advantage of the no state transfer taxes and seller-paid customary fees to reduce closing costs.

Can I roll closing costs into my mortgage loan?

Many lenders offer no-closing-cost loans where fees are added to your loan amount or offset by higher interest rates. This reduces upfront costs but increases your total borrowing amount.

What’s the difference between closing costs and down payment?

Your down payment is the portion of the purchase price you pay upfront. Closing costs are fees you need to pay for loan processing and property transfer services.

When do I pay closing costs?

Most closing costs are paid at your closing date, though some fees like home inspections and appraisals may be paid earlier in the process.

How accurate is my Loan Estimate?

Loan estimates are generally pretty accurate. Final costs on your Closing Disclosure may vary slightly, but federal law limits how much certain fees can increase.

Preparing for Your Closing

Understanding what’s included in closing costs helps you budget effectively for your Texas home purchase. Work with experienced professionals who understand local market customs and can guide you through the process.

Ready to start your home buying journey? Contact South Texas Lending today for personalized guidance and a detailed estimate of your closing costs based on your specific situation and loan program.

South Texas Lending is a licensed mortgage lender serving San Antonio and South Texas. NMLS#: [License Number]. Equal Housing Opportunity Lender. This information is for educational purposes. Loan approval subject to credit approval and program guidelines.

Contact: (210) 750-6461 | stxlending.com