If you’re comparing FHA and conventional loans in San Antonio, you’ve likely noticed something confusing: FHA loan interest rates appear lower, but their Annual Percentage Rates (APRs) are actually higher than conventional loans. This puzzling difference affects thousands of Texas homebuyers and can significantly impact your total borrowing costs.

The Quick Answer: FHA APRs are higher than conventional loan APRs primarily because APR calculations include the upfront mortgage insurance premium of 1.75% of the loan amount, plus ongoing monthly mortgage insurance premiums. While FHA loans often offer lower interest rates, these mandatory insurance costs push the true annual percentage rate above conventional loan rates.

Understanding APR vs Interest Rate: What’s Really Going On Here

Here’s where many homebuyers get confused: the difference between what lenders advertise and what you actually pay.

Interest rate? That’s straightforward. It’s what you pay to borrow money.

APR? That’s where things get interesting.

What Is an Interest Rate?

Simple enough. On a $300,000 loan at 6.25%, you’re paying 6.25% per year in interest. Period. This number determines your monthly payment amount.

What Is Annual Percentage Rate (APR)?

Now we’re getting to the meat of it. APR includes your interest rate PLUS all the other stuff they tack on. Origination fees, discount points, and here’s the kicker for FHA loans – mortgage insurance premiums.

The government makes lenders show you the APR so you can’t get blindsided by a “great” rate that comes with massive fees.

Why This Matters When You Compare Lenders

Here’s what you might see shopping around San Antonio:

- FHA Loan: 6.25% interest rate, 7.15% APR

- Conventional Loan: 6.50% interest rate, 6.75% APR

Wait, what? The FHA rate looks better, but that APR tells a different story.

Why FHA APRs Are Higher Than Conventional: Here’s the Deal

The culprit? Mortgage insurance. FHA loans come with insurance costs that conventional loans often dodge completely.

Let me break this down for you.

1. That Upfront Fee Hits You Right Away

Every single FHA borrower gets hit with an upfront mortgage insurance premium. We’re talking 1.75% of your entire loan amount. Right off the bat.

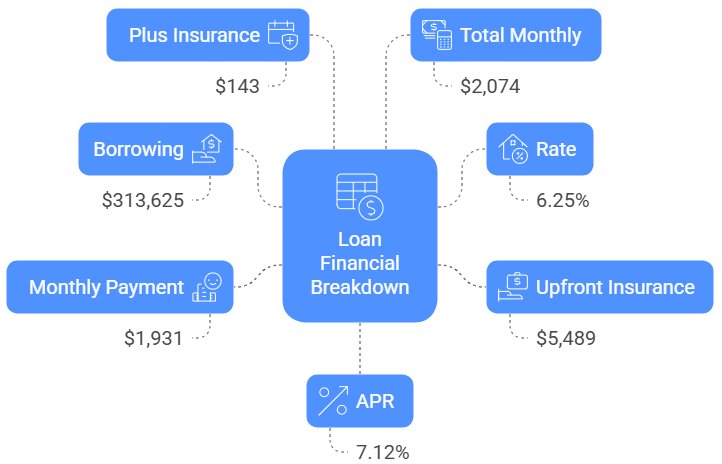

Real San Antonio numbers:

- Buying a $325,000 home (pretty typical around here)

- Put down 3.5%, so you’re borrowing $314,000

- Upfront fee: $5,495

You can pay this at closing if you’ve got the cash, or roll it into your loan. Either way, it cranks up your APR.

2. Then There’s the Monthly Hit

On top of that upfront cost, you’re paying monthly mortgage insurance too. Currently runs about 0.55% per year for most folks.

What that looks like:

- Same $314,000 loan

- Annual insurance cost: $1,727

- Monthly: $144

And here’s the kicker – if you put down less than 10%, you’re stuck with this payment for the entire 30 years.

3. How This Jacks Up Your APR

Lenders take that big upfront fee and spread it over 30 years, then add the monthly costs. It’s like paying interest on top of interest.

Your real cost breakdown:

- Interest rate: 6.25%

- All that insurance stuff factored in

- Your actual APR: ~7.15%

That’s nearly a full percentage point higher than your interest rate!

4. Conventional Loans Play by Different Rules

Conventional loans? They’re not playing the same game. No upfront insurance fees required. PMI only kicks in if you put down less than 20%. And the best part? You can dump PMI once you hit 20% equity.

Why conventional APRs stay lower:

- Zero upfront insurance costs

- PMI disappears when you reach 20% equity

- Overall cheaper fee structure (if you qualify)

FHA vs Conventional: Real Numbers from Real San Antonio Buyers

Let’s get straight to the facts. What do buyers in San Antonio actually pay? I’ve seen these scenarios play out hundreds of times.

Here’s the real deal on how FHA and Conventional loans compare in the real world.

The First-Timer with OK Credit

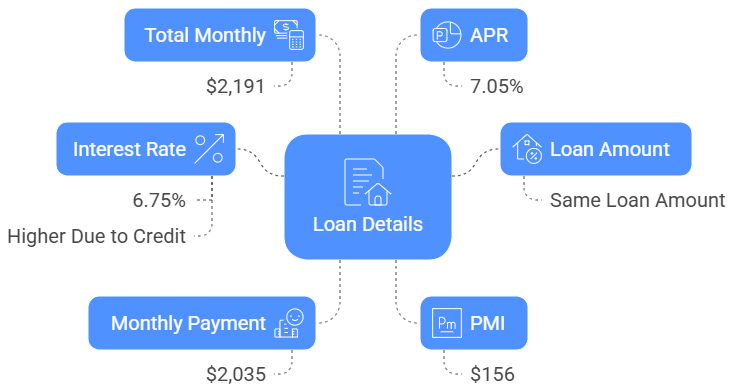

Meet Sarah and Mike:

FHA route:

Conventional route:

The verdict? FHA saves them $117 per month. That APR difference doesn’t tell the whole story when you’re stretching to qualify.

The Buyer with Good Credit and Real Money Down

Meet Jennifer:

- Income: $85,000

- Credit score: 740

- Down payment: $65,000 (she’s been saving)

- Same $325,000 house

FHA numbers:

- Borrowing: $260,000

- Rate: 6.00%

- Upfront insurance: $4,550

- Monthly payment: $1,559

- Insurance: $119

- Total: $1,678

- APR: 6.78%

Conventional numbers:

- Same loan amount

- Rate: 6.25%

- No upfront hits

- Monthly payment: $1,601

- No PMI (20% down rocks)

- Total: $1,601

- APR: 6.25%

No contest here. Conventional wins by $77 monthly and a much better APR.

When FHA Still Makes Sense (Even with That Higher APR)

Look, I get it. That APR stings. But sometimes FHA is still your best bet.

Here’s when I tell clients to go FHA anyway.

Your Credit Isn’t Perfect

FHA will work with you down to a 580 credit score. Some lenders even go to 500 if you put 10% down. Conventional? Good luck getting anything decent below 620.

I’ve seen borrowers with 640 scores get FHA rates that beat conventional by half a percentage point. When your credit’s not stellar, FHA often wins despite the insurance costs.

You’re Cash-Poor

Only got 3.5% to put down? FHA doesn’t judge. Plus, that down payment can come from gifts, grants, or assistance programs. Try that with conventional – they’re pickier about where your money comes from.

Your Debt Ratios Are Tight

FHA lets you push debt-to-income ratios up to 50% or sometimes higher. Conventional loans? They start sweating at 43%.

You Can Use Texas Programs

Here’s where FHA really shines in San Antonio. City programs like HIP can give you up to $15,000 for down payment help. TSAHC offers below-market rates. These programs love FHA loans.

You’re Planning to Refinance

Smart strategy I see all the time: Use FHA to get in the door, build some equity, improve your credit, then refinance to conventional in a few years. Boom – no more mortgage insurance.

The Mortgage Insurance Game

Here’s how FHA mortgage insurance works:

- Put down less than 10%? You’re stuck with it for 30 years

- Put down 10% or more? It drops off after 11 years

- Want out sooner? Refinance when you hit 20% equity

The refinance route is popular around here. San Antonio’s appreciation helps you get there faster.

Shopping Lenders: How to Find the Best Deal Despite Higher APRs

Sometimes, lenders show higher APRs, but that doesn’t mean you’re out of luck. With a little smart shopping, you can still save thousands.

Here’s the simple approach I share with my clients to help them find the best deal.

Don’t Just Look at the Pretty Rate

First mistake I see? Falling for the lowest advertised rate. That 6.25% might look great until you see the fees. Always ask for the Loan Estimate – that’s where the real numbers live.

Get at Least Three Quotes

Not suggestions. Not “I’ll think about it.” Get actual Loan Estimates from three different lenders. The differences will surprise you.

Ask the Right Questions

Questions that actually matter:

- What’s your rate for MY credit score? (not the advertised rate)

- What’s the APR with all your fees included?

- How much are closing costs, really?

- Do you keep loans in-house or sell them?

- Can you close in my timeframe?

- Ever worked with [insert local program name]?

What Drives Your FHA Rate

Your rate isn’t random. It’s based on:

- Credit score (biggest factor)

- Debt-to-income ratio

- Down payment amount

- Loan size

- Current market conditions

- Individual lender pricing (this varies more than you think)

The Shopping Strategy That Works

- Apply with 3-5 lenders within a 14-day window (only counts as one credit pull)

- Compare Loan Estimates line by line

- Factor in closing timeline and service quality

- Don’t forget about local programs – some lenders know them, others don’t

The right lender makes a bigger difference than most people realize.

Texas-Specific Programs That Offset Higher FHA Costs

There are local and state programs that can help lower the impact of FHA’s higher APRs by offering down payment assistance and lower interest rates for qualified borrowers.

City of San Antonio Programs

Homeownership Incentive Program (HIP 120):

- Up to $15,000 in down payment assistance

- Zero percent interest, forgivable over 10 years

- Compatible with FHA loan programs

- Income limits typically 80% of area median income

State of Texas Programs

Texas State Affordable Housing Corporation (TSAHC):

- Below-market interest rates for FHA loans

- Down payment assistance up to 5% of loan amount

- First-time homebuyer friendly programs

- Multiple loan programs including FHA options

My First Texas Home Program:

- 30-year fixed-rate financing with competitive rates

- Down payment assistance available

- Works seamlessly with FHA loan requirements

- Credit score requirements as low as 640

Making the Call: FHA or Conventional?

Forget the generic advice. Here’s how to actually decide based on what I see working in San Antonio.

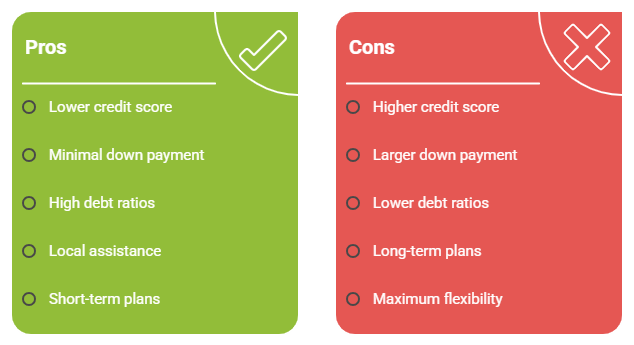

Go FHA If:

- Your credit score is under 680

- You’ve got minimal cash for down payment

- Your debt ratios are pushing 45%+

- You qualify for local assistance programs

- You’re planning to move or refinance within 5-7 years

- You want government backing (some people sleep better with it)

Go Conventional If:

- Your credit score is over 720

- You can swing 10-20% down (or more)

- Your debt ratios are comfortable under 40%

- You’re planning to stay put for 10+ years

- You can hit that magic 20% down payment (no PMI!)

- You want maximum flexibility

The “FHA Now, Conventional Later” Strategy

This one’s popular around here:

- Start with FHA – get in the door with minimal cash

- Build equity – San Antonio appreciation helps

- Improve credit – pay on time, pay down debt

- Refinance conventional – ditch the mortgage insurance

With home values rising, this strategy can work well if you’re disciplined about it.

Frequently Asked Questions

Are FHA loan interest rates actually lower than conventional rates?

Usually, yes. FHA rates typically run about 0.125% to 0.25% lower than conventional, especially if your credit’s not perfect. But here’s the catch – once you factor in all that mortgage insurance, your total cost (the APR) often ends up higher.

Why is my FHA loan APR so much higher than the interest rate?

Blame the mortgage insurance. That 1.75% upfront fee plus the monthly premiums get rolled into the APR calculation. So even though your interest rate might be 6.25%, your APR could hit 7.15% or higher.

Can you remove mortgage insurance from FHA loans?

Depends on how much you put down initially:

- Less than 10% down? You’re stuck with it for 30 years

- 10% or more down? It disappears after 11 years

- Want out sooner? Refinance to conventional once you hit 20% equity

What credit score do you need for FHA vs conventional loans?

FHA: As low as 580 with 3.5% down, or 500 with 10% down Conventional: Usually 620 minimum, but you’ll want 680+ for decent rates

The sweet spot for FHA is typically 580-680. Above 720, conventional often wins.

How much is FHA mortgage insurance in San Antonio?

For a typical $314,000 loan around here:

- Upfront: $5,495 (1.75% of loan amount)

- Monthly: About $144 (0.55% annually ÷ 12)

That monthly payment sticks around for the life of the loan if you put down less than 10%.

Ready to Explore Your Options?

Understanding why FHA APRs are higher than conventional loans helps you make informed decisions about your San Antonio home purchase. While FHA loans carry higher APRs due to mandatory mortgage insurance, they remain excellent options for many first-time homebuyers and those with limited down payment funds.

Contact South Texas Lending today for personalized rate quotes on both FHA and conventional loans. Our local expertise with Texas programs and San Antonio market conditions ensures you get the best possible terms for your situation.

South Texas Lending is committed to helping San Antonio homebuyers navigate complex loan decisions with clear, honest guidance. NMLS #[237341]. Equal Housing Lender.