Quick answer: Most lenders require a minimum upfront payment of 3% with conventional loans in San Antonio. The median home price in the city is at $296,885. That means you can put as little as $8,907 down to secure a conventional home loan, bringing your San Antonio homeownership dreams closer to reality.

In the following sections, we’ll go in-depth into the San Antonio’s conventional loan requirements and the available down payment assistance programs. We’ll also discuss how conventional loan borrowers can take advantage of the:

- flexible terms

- competitive interest rates

- ability to remove private mortgage insurance once you reach 20% equity in your home

Understanding Conventional Loans and Down Payment Requirements

A conventional loan is a type of mortgage that isn’t backed by the federal government, like FHA or VA loans are. Instead, it’s offered through private lenders, such as banks, credit unions, and mortgage companies.

This type of loan typically follows lending rules set by Fannie Mae and Freddie Mac, two government-sponsored organizations. Most conventional loans are what’s called conforming loans. This means they meet specific guidelines for income, credit, and loan size, set by Fannie Mae and Freddie Mac.

To qualify as conforming, the loan must also fall within limits set each year by the Federal Housing Finance Agency (FHFA).

Minimum Down Payment on Conventional Loan Requirements

First-time homebuyers or those who haven’t owned a home in the past three years can secure most conventional loans with a minimum down payment of 3%. However, if you’ve owned a home within the last three years, lenders require at least 5% down for conventional mortgage loans.

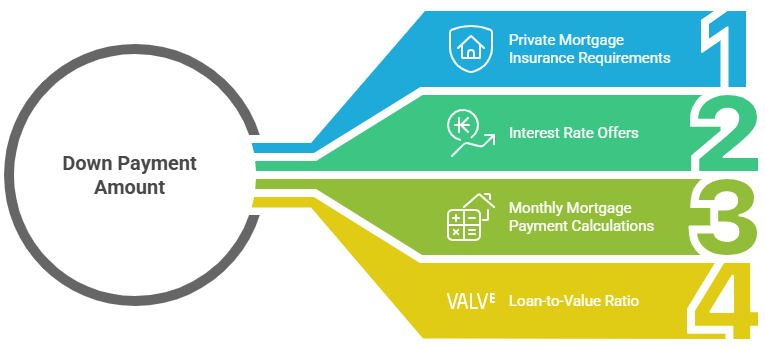

The down payment amount affects several factors:

Conventional Loan Limits in San Antonio (2025)

For 2025, the conforming conventional loan limit for San Antonio is $806,500 for a single-family home. This represents the maximum loan amount that Fannie Mae and Freddie Mac will purchase from lenders. Any loan amount exceeding these conventional loan limits becomes a jumbo loan with different requirements.

Credit Score Requirements for Conventional Loans

You need to have a 620 minimum credit score to qualify for conventional loans. Your credit score also impacts your down payment and interest rates. For instance, a higher credit score may help you qualify for lower interest rates.

620-679 Credit Score:

- May require larger down payment amounts

- Higher interest rates than borrowers with excellent credit

- Limited access to some low down payment programs

680-739 Credit Score:

- Access to 3% down payment programs for first-time buyers

- Competitive interest rates

- Standard debt to income ratio requirements

740+ Credit Score:

- Best available interest rates

- Lowest private mortgage insurance premiums

- Most flexible conventional loan requirements

Impact of Credit History on Down Payment Requirements

Lenders require borrowers with lower credit scores to make a larger down payment to offset the increased risk. A higher credit score can help you qualify for programs with lower down payment requirements and better loan terms.

Private Mortgage Insurance with Conventional Home Loans

If you’re taking out a conventional home loan and your down payment is less than 20% of the home’s price, you’ll likely have to pay for private mortgage insurance (PMI). This insurance helps protect the lender if you stop making loan payments.

The good news? PMI doesn’t last forever. You can ask your lender to remove it once you’ve reached 20% equity in your home. This is one big difference from mortgage insurance on FHA loans, which usually lasts much longer.

PMI Costs and Calculations

PMI typically costs between 0.3% to 1.5% of the loan amount annually. Several factors affect your mortgage insurance premiums:

- Credit score (higher scores get lower rates)

- Down payment amount (larger payments reduce PMI)

- Loan-to-value ratio

- Loan amount and property type

San Antonio PMI Example:

- Home price: $296,885

- 3% down payment: $8,907

- Loan amount: $287,978

- Annual PMI: $1,440-$4,320 (0.5%-1.5%)

- Monthly PMI: $120-$360

Debt to Income Ratio Requirements for Conventional Mortgages

Your debt-to-income ratio (DTI) measures how much of your monthly income goes toward paying debts. It’s calculated by dividing your total monthly debt payments by your pre-tax monthly income.

Most lenders require conventional loans to have:

Front-end DTI: Generally 32% or less (housing expenses only) Back-end DTI: Typically 45% or less (all debt payments including the new mortgage payment)

Some lenders may accept higher debt to income ratios if you have:

- Excellent credit scores

- Larger down payment amounts

- Substantial cash reserves

- Strong employment history

Calculating Your DTI for San Antonio Home Purchases

Using San Antonio’s median home price of $296,885 with a 3% down payment:

- Monthly mortgage payment: ~$2,100 (including taxes, insurance, PMI)

- Required gross monthly income: ~$6,563 (32% front-end DTI)

- Annual income needed: ~$78,750

Conventional vs FHA vs USDA Loans: Down Payment Comparison

Let’s compare conventional loans with government-backed loans, so you can see which options suit your needs.

Conventional Loans

- Minimum down payment: 3% (first-time buyers)

- Credit score requirements: 620+ typically

- Mortgage insurance: PMI removable at 20% equity

- Loan limits: $806,500 in San Antonio

FHA Loans

- Minimum down payment: 3.5% with 580+ credit score

- Credit score requirements: 580+ (500+ with 10% down)

- Mortgage insurance: MIP for life of loan or 11 years

- Loan limits: $449,650 in San Antonio

USDA Loans

- Minimum down payment: 0%

- Credit score requirements: 640+ typically

- Mortgage insurance: Annual guarantee fee

- Income limits: Apply based on area median income

Down Payment Assistance Programs in San Antonio

San Antonio homebuyers can make the most of these payment assistance programs to lower upfront costs.

Texas State Affordable Housing Corporation

- Down payment assistance up to 5% of loan amount

- Below-market interest rates

- Income and purchase price limits apply

- Must be primary residence

San Antonio Housing Authority Programs

- First-time homebuyer assistance

- Down payment and closing cost help

- Homebuyer education requirements

- Income qualification guidelines

Fannie Mae HomeReady Program

- 3% minimum down payment

- Reduced private mortgage insurance costs

- Income limits apply (varies by household size)

- Flexible funding sources for down payment

Benefits and Drawbacks of Low Down Payment Conventional Loans

Making a low down payment on conventional loans has its pros and cons.

Here’s a breakdown:

Advantages of 3% Down Conventional Mortgages

- Earlier homeownership: Start building equity sooner than saving for 20%

- Preserve cash reserves: Keep money for emergencies and other expenses

- Removable PMI: Unlike FHA loans, mortgage insurance ends at 20% equity

- Competitive rates: Often better than government backed mortgages

- Property flexibility: Use for primary residence, second home, or investment properties

Considerations for Low Down Payment Options

- Higher monthly payments: PMI adds to monthly mortgage payment

- More interest paid: Larger loan amount means more interest over time

- Loan officers may require: Additional documentation or reserves

- Market conditions: May affect competitiveness in seller’s markets

Qualifying for Conventional Loan Requirements

To qualify for a conventional loan, you’ll typically need:

Income and Employment Requirements

- Stable employment history: Typically 2 years in same field

- Sufficient income: Ability to meet debt to income guidelines

- Documentation: Pay stubs, tax returns, W-2 forms

- Self-employed applicants: Additional profit/loss statements required

Asset and Reserve Requirements

- Down payment funds: Bank statements showing source of funds

- Closing costs: Additional cash needed beyond down payment

- Reserves: Some loans require 2-6 months of mortgage payments saved

- Gift funds: Allowed from family members with proper documentation

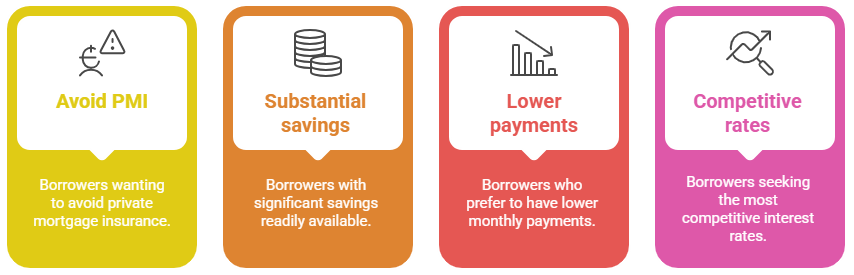

Choosing the Right Down Payment Amount in San Antonio

The optimal down payment boils down to your unique financial situation and home buying goals.

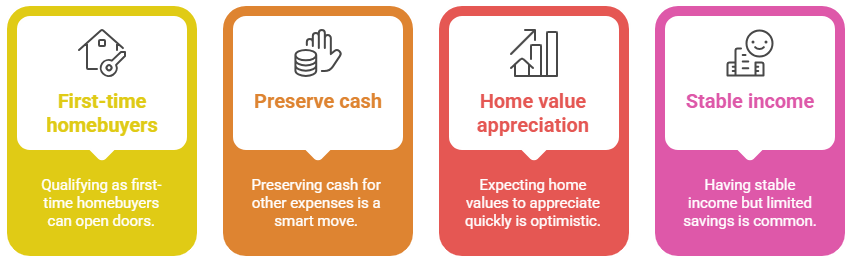

3% Down Payment Strategy

Best for borrowers who:

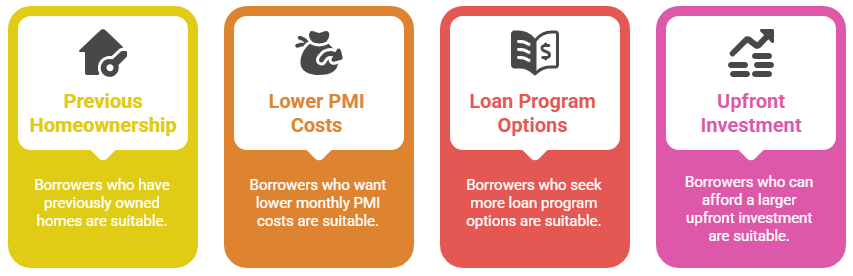

5-10% Down Payment Approach

Suitable for borrowers who:

20% Down Payment Benefits

Ideal for borrowers who:

Current San Antonio Housing Market Advantages

Getting a conventional loan to buy a home in San Antonio has its perks:

Market Conditions

- Buyer-friendly environment: More inventory and negotiation opportunities

- Competitive pricing: Lower than Austin and Dallas markets

- Growing economy: Strong job market supporting home values

- Population growth: Continued demand from new residents

Local Economic Factors

- Military presence: Joint Base San Antonio provides stability

- Healthcare expansion: Growing medical sector employment

- Technology growth: Emerging cybersecurity and tech industries

- Tourism industry: Stable service sector employment

Working with Experienced Loan Officers

The right lender can make the process of securing a home loan a seamless experience. South Texas Lending offers:

Local Market Expertise

- San Antonio specialization: Deep understanding of local market conditions

- Texas lending experience: Over 20 years serving Texas homebuyers

- Neighborhood knowledge: Familiarity with area property values and trends

- Local connections: Relationships with real estate professionals

Streamlined Process

- Quick pre-approval: Often within 24-48 hours with complete documentation

- Competitive rates: Direct lender advantages

- Personalized service: Local decision-making and support

- Technology integration: Online application with human support

Steps to Secure Your Conventional Home Loan

1. Check Your Credit Score and History

Review your credit reports for accuracy and work to improve your score if needed. Most borrowers benefit from scores of 740 or higher for the best conventional loan terms.

2. Calculate Your Budget and DTI

Determine how much house you can afford based on your income, existing debt payments, and desired monthly mortgage payment including private mortgage insurance.

3. Save for Down Payment and Closing Costs

While the minimum down payment on conventional loan options is 3%, you’ll also need funds for closing costs, typically 2-5% of the purchase price.

4. Get Pre-Approved

Obtain pre-approval from a qualified lender to understand your buying power and strengthen your position when making offers on homes.

5. Work with Local Real Estate Professionals

Partner with experienced agents familiar with San Antonio neighborhoods and market conditions to find the right property for your needs and budget.

Understanding the minimum down payment on conventional loan requirements opens doors to homeownership in San Antonio’s attractive housing market. With options starting at just 3% down, competitive interest rates, and removable private mortgage insurance, conventional home loans offer flexibility and value for qualified borrowers. Whether you’re a first-time homebuyer or looking to upgrade, working with experienced local lenders ensures you get the best terms available for your situation.