You’re scrolling through real estate listings in San Antonio when you spot your dream home—perfect location, ideal price range, everything you want. But then you notice the dreaded status: “Pending.” Your heart sinks. Does this mean you’ve lost your chance completely?

What does pending mean in real estate? In simple terms, pending means a seller has accepted a buyer’s offer and all contingencies have been satisfied, but the sale hasn’t closed yet. While this significantly reduces your chances as a prospective buyer, it doesn’t necessarily mean all hope is lost.

Understanding pending status is crucial in today’s San Antonio market, where homes receive an average of 2 offers and the pending stage typically lasts 30-60 days. Whether you’re a first-time homebuyer or experienced investor, knowing what pending means—and your options—could make the difference between finding your next home and missing out entirely.

What Does Pending Mean in Real Estate?

When a home sale is marked as pending, it means the seller has accepted the buyer’s offer, and most of the important conditions have been met or waived. At this point, both sides are getting ready to close the deal. This is the final step before the property officially changes ownership.

Although the sale isn’t complete yet, things are moving forward and the home is usually taken off the market.

When a property reaches pending status, several critical milestones have typically been achieved:

- The seller accepts the buyer’s offer and signs a purchase and sale agreement

- All contract contingencies are satisfied (inspection, appraisal, financing)

- Both parties are committed to proceeding to closing

- The property is no longer actively marketed to other buyers

The key difference: Unlike homes marked “for sale” or “under contract,” pending properties have cleared most hurdles that commonly cause real estate deals to fall through. However, pending doesn’t mean sold—the transaction isn’t final until closing documents are signed and funds transfer.

In the current San Antonio market, pending sales have a approximately 95% success rate, meaning only about 5% of pending home sales fall through before closing.

Pending vs Contingent vs Under Contract: Key Differences

When searching for your ideal home or applying for a loan, chances are you’ll encounter many unfamiliar real estate jargon. It can be overwhelming, especially when the different terms seem to describe similar situations.

Here’s how these three status designations differ:

Under Contract

When a home goes under contract, the seller has accepted the buyer’s offer and both parties have signed a purchase agreement. However, the deal still has outstanding contingencies that must be satisfied.

Characteristics:

- Purchase and sale agreement signed

- Multiple contingencies typically remain

- Higher likelihood of falling through

- Seller may still accept backup offers

- Usually the first 2-4 weeks after offer acceptance

Contingent

A contingent sale means the seller has accepted an offer, but the deal depends on specific conditions being met. Common contingencies include financing contingency, inspection contingency, and appraisal contingency.

Types of contingencies:

- Financing contingency: Buyer must secure acceptable mortgage loan terms

- Inspection contingency: Property must pass professional inspection

- Appraisal contingency: Home must appraise at or above purchase price

- Home sale contingency: Buyer must sell their current property first

Pending

Pending status indicates all contingencies have been satisfied and the sale is proceeding toward closing. This is the most advanced stage before final sale completion.

| Status | Contingencies Remaining | Backup Offers Accepted | Success Rate |

|---|---|---|---|

| Under Contract | Multiple | Often | 85-90% |

| Contingent | Some | Usually | 90-95% |

| Pending | None/Minimal | Rarely | 95%+ |

How Long Does a House Stay Pending?

Most homes stay in the pending stage for about 30-60 days, according to the National Association of Realtors. The time between when a seller accepts an offer and when the sale is officially closed can vary based on different factors.

Factors Affecting Pending Timeline

Purchase method:

- Cash purchases: 7-14 days typically

- Conventional mortgage loan: 30-45 days

- FHA/VA loans: 45-60 days due to additional requirements

Market conditions: In San Antonio’s current market, the average pending period is 52-74 days, with homes staying on market longer than in previous years due to increased inventory and more balanced conditions.

Transaction complexity:

- Simple, move-in ready properties: Faster processing

- Properties requiring repairs: Extended timelines

- Title issues: Can add significant delays

- Lender processing speed: Varies by institution

Seasonal factors: Spring and summer months often see longer processing times due to higher transaction volumes, while winter months may have shorter pending periods.

What Happens During the Pending Stage?

The pending stage is one of the busiest parts of buying or selling a home. Once the seller accepts an offer, several important steps happen before the deal is finalized.

These can include:

Final Mortgage Processing

Your lender conducts final loan review, including employment verification, asset confirmation, and property appraisal review. At STX Lending, we maintain close communication during this phase to address any underwriter requests quickly and prevent delays.

Property Preparations

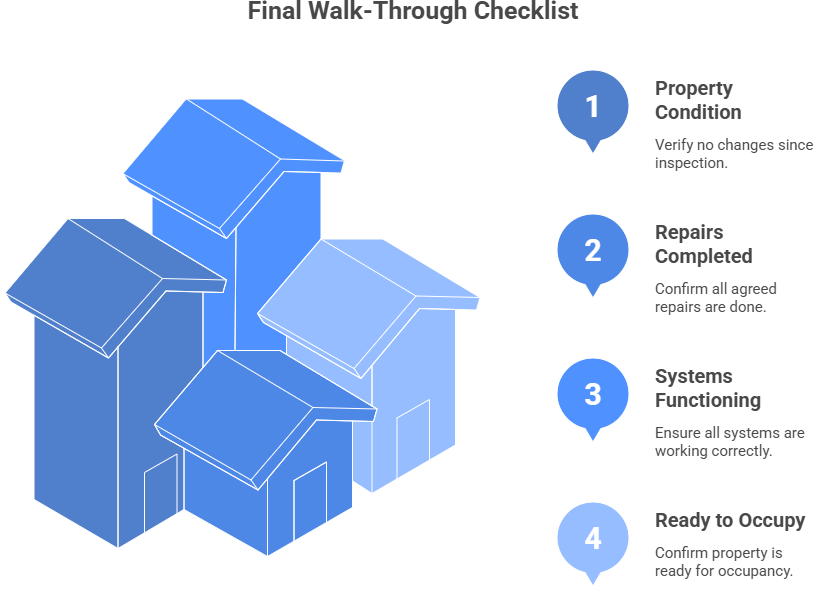

Final walk-through: Conducted 24-48 hours before closing to ensure:

Title and Escrow Activities

The title company performs final title searches, prepares closing documents, and coordinates the closing appointment. This includes ensuring all liens are properly addressed and ownership can transfer cleanly.

Document Preparation

Critical paperwork prepared includes final loan documents, deed preparation, property tax prorations, and insurance coordination.

Can You Make an Offer on a Pending House?

Yes, you can still submit an offer, but it’s called a backup offer.

Here’s what you need to know about backup offers and when they make sense.

Understanding Backup Offers

A backup offer is a contingent purchase agreement that becomes active only if the primary pending sale falls through. Think of it as getting in line behind the current buyer.

When sellers accept backup offers:

- Concerns about current buyer’s financing strength

- Property has been pending unusually long

- Known complications with current transaction

- Contract includes a kick out clause allowing continued marketing

Making a Competitive Backup Offer

Research the situation first: Have your real estate agent contact the listing agent to understand the current deal’s strength and whether backup offers are being considered.

Submit your strongest offer:

- Full asking price or above market value

- Minimize contingencies where possible

- Flexible closing timeline

- Strong earnest money deposit

- Pre-approval letter from reputable lender

Set realistic expectations: With only 5% of pending sales falling through, backup offers are essentially betting on that small percentage of failed deals.

Why Do Pending Sales Fall Through?

Most pending sales go through, but sometimes things don’t work out. Common reasons include:

Financing Issues (Most Common)

Loan problems remain the top reason pending sales fail. Even buyers with pre-approval can face issues like:

- Employment changes after initial approval

- Credit score changes during pending period

- Asset verification problems

- Income documentation issues

How STX Lending prevents financing failures:

- Comprehensive initial review

- Regular communication throughout pending period

- Proactive problem-solving

- Local market expertise

Appraisal Problems

If the property appraises for less than the purchase price, buyers face several options:

- Make up difference in cash

- Renegotiate purchase price with seller

- Request second appraisal

- Walk away using appraisal contingency

In San Antonio’s current market, with homes selling approximately 3% below list price, appraisal issues are less common than during peak market periods.

Inspection and Property Issues

Final walk-through discoveries:

- Previously undetected problems

- Damage occurring between contract and closing

- Incomplete agreed-upon repairs

- New issues affecting habitability

Buyer’s Remorse and Life Changes

Sometimes buyers experience second thoughts or face unexpected life changes:

- Job loss or relocation

- Family circumstances change

- Financial situation deteriorates

- Discovery that property doesn’t meet needs

Title and Legal Complications

Title issues that can derail closing:

- Undisclosed liens or judgments

- Ownership disputes

- Survey problems

- HOA complications

Pending Home Buying Tips for San Antonio

If you want to try your luck at buying a pending home in San Antonio, you might want to keep these tips handy:

Strengthen Your Position

Get pre-approved: Obtain comprehensive pre-approval from a local lender like STX Lending rather than just pre-qualification.

Prepare financially: Have all documentation organized and avoid major financial changes during your home search.

Work with local experts: Partner with experienced San Antonio real estate agents and lenders who understand local market conditions.

If Your Target Home Goes Pending

Consider backup offers carefully: Only pursue if the property truly meets your unique needs and you’re prepared to wait.

Continue your search actively: Don’t put your home buying on hold while waiting for a pending sale to potentially fall through.

Stay ready to act: Keep your pre-approval current and finances prepared for new opportunities.

Understanding San Antonio Market Conditions

The current San Antonio market shows signs of becoming more buyer-friendly, with 15,056 active listings providing more options than previous years. This increased inventory means:

- More negotiating power for buyers

- Longer average days on market

- Better opportunities for backup offers compared to seller’s markets

Frequently Asked Questions About Pending Real Estate

How long does it take for a house to go from pending to sold?

Pending sales typically take 30-60 days to close, though cash purchases can close in as little as 7-14 days. In San Antonio specifically, the current average is 52-74 days for financed purchases.

What percentage of pending sales fall through?

Approximately 5% of pending sales fall through before closing, according to National Association of Realtors data. This means 95% of pending home sales successfully close.

Can a seller accept another offer while pending?

Generally no. Once pending, sellers are contractually obligated to complete the transaction with the current buyer. However, they may accept backup offers that would only activate if the primary sale fails.

What’s the difference between pending and sold?

Pending means the sale is in progress but not complete, while sold means the transaction has closed and ownership has transferred. During pending, final steps like funding and document signing still occur.

Can real estate agents show pending homes?

Technically yes, since pending homes are still on the market. However, most real estate agents won’t show pending properties because the vast majority close successfully, and it’s often inconvenient for sellers.

What does “pending – taking backups” mean?

This indicates the seller is accepting backup offers while the primary sale proceeds. This often occurs when there are concerns about the current deal’s strength or the property has been pending longer than usual.

Conclusion: Navigating Pending Properties in San Antonio

Knowing what “pending” means in real estate helps you stay ahead in San Antonio’s competitive housing market. While most pending deals do close, some fall through, giving prepared buyers a second chance. If you’re serious about a home that’s pending, talk to your real estate agent so you can be ready in case a deal doesn’t go through.

Key takeaways:

- Pending properties have satisfied contingencies and are moving toward closing

- Only about 5% of pending sales fall through

- Backup offers are possible but require realistic expectations

- Continue searching actively rather than waiting for pending properties

Ready to navigate San Antonio’s real estate market effectively? STX Lending’s local expertise and established relationships help you understand market conditions and act quickly when opportunities arise. Our comprehensive pre-approval process gives you credibility with sellers and positions you to succeed.

Contact STX Lending today for personalized guidance on your San Antonio home purchase. Whether you’re considering backup offers or searching for active listings, our South Texas mortgage expertise helps you make informed decisions and move quickly when the right opportunity presents itself.