Quick answer: No, you cannot use a Debt Service Coverage Ratio or DSCR loan for a primary residence. It’s against loan conditions and federal regulations to use DSCR loans for a home you want to live in. They’re only intended for investment properties that provide rental revenue.

Let’s say you’re thinking about buying a home. In its current real estate market, where median home prices are roughly $297,000, it would be wise to look at better financing options. Although DSCR loans have become popular among real estate investors for buying rental properties, they’re not the best option for buying your primary home.

In the following sections, we’ll explain the reasons why you can’t use DSCR loans for primary residences and explore better financing alternatives available for homebuyers.

What is a DSCR Loan?

DSCR stands for Debt Service Coverage Ratio, and these loans are ideal for real estate investors who want to buy rental properties.

Here’s how lenders assess the loan application:

Instead of looking at your personal income or your W-2 and tax returns, DSCR lenders focus on the property’s operating cash flow or the its ability to pay for the loan.

Let’s dig a little deeper.

How the Debt Service Coverage Ratio Works

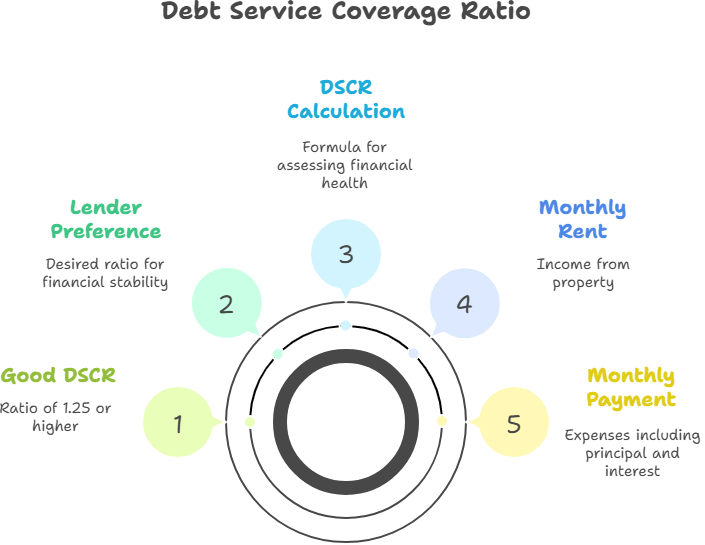

The calculation is actually pretty simple:

DSCR = Monthly Rent ÷ Monthly Payment (Principal + Interest + Taxes + Insurance + HOA)

Most lenders want to see at least 1.0, which means the rent covers the payment. But they really prefer 1.25 or higher – that gives you some breathing room for vacancies and repairs.

Let’s say you’ve got a property that brings in $2,500 a month in rent, and your total payment is $2,000. That gives you a DSCR of 1.25 ($2,500 ÷ $2,000). That’s what most lenders call a “good” ratio.

How DSCR Loans Work for Investors

These are what’s called non-qualified mortgage products – basically, they don’t follow all the same rules as regular home loans. Instead of digging through your pay stubs and tax returns, lenders care about one thing: can this property pay for itself?

This approach lets investors:

- Buy multiple properties without showing personal income

- Get approved based on what the property makes, not what you make

- Skip a lot of the paperwork headaches

- Build their portfolio faster

The trade-off? You’re looking at higher interest rates (usually 1-3% more than regular mortgages), bigger down payments (20-25%), and most lenders hit you with prepayment penalties if you pay off early.

Typical DSCR Loan Requirements

Most DSCR lenders establish these basic requirements:

- Minimum credit score of 620-680 (varies by lender)

- Down payment of 20-25% of property value

- Property appraisal confirming market rent potential

- Property must be non-owner occupied investment property

- Minimum loan amounts typically start at $100,000

- Three to six months of mortgage payment reserves

Why You Can’t Use a DSCR Loan for Your Primary Residence

It is simply not possible to purchase a property you plan to live in with a DSCR loan. Period. This isn’t some gray area or loophole situation. It’s how this type of loan legally work.

Let me explain further.

The Legal Side of Things

DSCR loans fall under what’s called “business purpose” lending. That means they can only be used for investment properties – not homes you’re going to live in. The Consumer Financial Protection Bureau and other federal agencies are pretty clear about this.

Our Department of Savings and Mortgage Lending keeps an eye on this stuff too. If you try to use a DSCR loan for your primary residence, you’re violating both federal and state lending rules. That’s not a place you want to be.

Why the Math Doesn’t Work

Think about it this way – the whole point of a DSCR loan is that the property makes money from rent. That rent money is what pays the mortgage. If you’re living in the house, there’s no rent coming in, so the whole calculation falls apart.

Primary residences just don’t generate rental income the way lenders need to see it. Even if you thought about renting out rooms, lenders specifically write these loans for properties where the owner doesn’t live there. Your occupancy kills the rental income potential they’re counting on.

Industry Standards and Lender Policies

Major DSCR lenders, including Griffin Funding, Visio Lending, and other national lenders, maintain strict policies prohibiting the use of these loans for primary residences. This universal restriction across the lending industry reflects both regulatory requirements and sound risk management principles.

Lenders offering DSCR products specify that these loans are for investment properties only and cannot be used for primary residences. Loan documents explicitly state that properties must be non-owner-occupied and generate rental income to qualify.

These industry-wide restrictions exist because:

- Federal regulations require business purpose classification

- Risk assessment models depend on rental income analysis

- Loan performance data shows investment properties have different risk profiles

- Secondary market investors purchasing these loans require non-owner-occupied properties

What Happens If You Try It Anyway

Look, I get it. You might be thinking “what if I just don’t tell them?” or “who’s gonna know?”. Trust me, that’s a road you don’t want to go down. The consequences are serious. And we’re talking about potential criminal charges here.

The Legal Trouble You’re Looking At

Using a DSCR loan for your primary residence isn’t just breaking loan terms – it’s mortgage fraud. That’s a federal crime that can land you in prison for up to 30 years and cost you up to $1 million in fines. Federal prosecutors don’t mess around with this stuff.

If they catch it during the loan process, they’ll shut it down immediately and might report you to the feds. If they find out after you close? They can demand you pay back the entire loan right now – not over 30 years, but immediately. Can’t do it? Hello foreclosure.

Financial Penalties and Long-term Credit Impact

Beyond legal consequences, financial penalties can be devastating. Most DSCR loans include prepayment penalties, meaning even if borrowers can repay the loan immediately upon discovery, they’ll face substantial fees ranging from 1-5% of the loan balance.

Legal costs for defending against fraud charges or foreclosure proceedings can quickly reach tens of thousands of dollars. These costs continue to accrue throughout legal proceedings, creating mounting financial pressure.

The long-term impact on credit scores and future borrowing ability can be catastrophic. Mortgage fraud remains on credit reports for seven years, and many lenders will permanently decline applications from borrowers with fraud history. This effectively eliminates the ability to obtain future mortgages or investment property loans.

Regulatory Compliance and Enforcement Actions

For lenders, violations can result in regulatory sanctions, fines, and potential loss of lending licenses. This is why reputable lenders maintain strict verification procedures, occupancy monitoring systems, and post-closing compliance checks.

Regulatory agencies actively monitor lending practices and investigate suspected violations. Borrowers who violate DSCR loan terms may find themselves subject to ongoing regulatory scrutiny that affects future financial transactions.

Better Ways to Finance Your Primary Residence

The good news? STX Lending has tons of great options for buying your primary residence, and most of them are way better deals than DSCR loans anyway.

From conventional mortgages to bank statement loans, there are plenty of financing alternatives to help you reach your dream of homeownership faster and smoother.

Conventional Mortgages – Still the Best Deal for Most People

Regular conventional mortgages are popular for a reason. They’ve got lower interest rates than DSCR loans (we’re talking 1-2% lower, which adds up fast), and you can put down as little as 3% if you’re a first-time buyer.

Here’s a real example: on a $300,000 house, the difference between a 7% DSCR loan and a 5.5% conventional mortgage is about $270 per month. That’s over $3,000 a year back in your pocket.

Plus, you get other benefits:

- No prepayment penalties if you want to pay it off early

- You can drop PMI once you hit 20% equity

- Tons of refinancing options down the road

- Better customer service since you’re not dealing with investment loan specialists

FHA Loans – Great for First-Time Buyers

If you don’t have a huge down payment saved up, FHA loans might be your best bet. You can get one with just 3.5% down, and they’ll work with you even if your credit score isn’t perfect (they’ll go as low as 580).

With home prices around $297,000, an FHA loan means you’d need about $10,400 for your down payment. Compare that to a DSCR loan where you’d need almost $60,000. That’s a massive difference.

The other cool thing about FHA loans? They’re assumable. That means if interest rates go up later and you want to sell, the buyer can take over your loan with your current rate. That can be a huge selling point.

VA Loans for Eligible Veterans and Military Personnel

Texas has one of the largest veteran populations in the nation, making VA loans particularly relevant for eligible borrowers. VA loans offer zero down payment, no private mortgage insurance requirements, and typically the most competitive interest rates available in the market.

For eligible veterans, a VA loan eliminates the need for any down payment on a $300,000 home purchase, compared to the $60,000-$75,000 required for a DSCR loan. The monthly payment savings from no PMI can exceed $200 monthly, adding significant long-term value.

VA Loan Benefits:

- Zero down payment required

- No private mortgage insurance (PMI)

- Competitive interest rates

- No prepayment penalties

- Cash-out refinancing up to 100% of home value

- Assumable loan options

- Funding fee can be financed into loan amount

VA loans also offer cash-out refinancing options up to 100% of home value, providing future flexibility that DSCR loans cannot match for primary residences.

USDA Rural Development Loans for Qualifying Areas

While most cities doesn’t qualify for USDA loans, many communities in the US do qualify. These loans offer zero down payment and below-market interest rates for qualifying areas and income levels.

While most cities in the US may qualify for USDA financing, offering another zero-down option for eligible buyers. Income limits apply, but for many first-time buyers, these programs provide exceptional value.

USDA Loan Features:

- Zero down payment for qualifying properties

- Below-market interest rates

- No private mortgage insurance

- Rural and suburban area eligibility

- Income limits based on area median income

- 30-year fixed-rate terms available

Bank Statement Loans for Self-Employed Borrowers

For self-employed borrowers or those with irregular income who might initially consider DSCR loans, bank statement loans offer a viable alternative for primary residences. These loans qualify borrowers based on bank deposits rather than traditional income verification through tax returns.

While bank statement loans typically require 10-20% down payments and carry slightly higher interest rates than conventional mortgages, they’re still generally better options than attempting to misuse DSCR loans. They’re specifically designed for primary residences and comply with all applicable regulations.

Bank Statement Loan Benefits:

- Income verification through bank statements

- No tax return requirements

- Self-employed borrower friendly

- Primary residence eligible

- Flexible qualification standards

- Various loan term options

Asset-Based Loans for High Net Worth Borrowers

Borrowers with substantial liquid assets but irregular income can qualify for asset-based loans. These programs consider savings, investments, and other liquid assets as qualifying income, often allowing for easier approval than traditional mortgages.

Asset-based loans work particularly well for retirees, entrepreneurs, or those with significant investment portfolios who don’t show traditional employment income. While rates may be slightly higher than conventional mortgages, they’re typically lower than DSCR loan rates and are legally appropriate for primary residences.

Asset-Based Loan Features:

- Qualification based on liquid assets

- No traditional income verification required

- Higher down payment requirements

- Competitive interest rates

- Primary residence eligible

- Flexible underwriting guidelines

How to Choose the Right Loan for Your Primary Residence Purchase

Selecting appropriate financing depends on your needs, budget, and financial goals.

Income Stability and Documentation Requirements

If you have traditional W-2 employment with steady income documentation, conventional or FHA loans typically offer the most competitive terms. The income verification process is straightforward, requiring recent pay stubs, W-2 forms, and employment verification.

Self-employed borrowers or those with irregular income should consider bank statement loans or stated income programs specifically designed for primary residences. These products offer the flexibility of DSCR loans without legal complications or regulatory violations.

Income Documentation Considerations:

- W-2 employees: Conventional or FHA loans offer best rates

- Self-employed: Bank statement loans provide flexibility

- Retirees: Asset-based loans utilize investment income

- Commission-based: Bank statement loans show actual earnings

- Variable income: Non-QM loans offer alternative qualification

Credit Score and Financial History Impact

Credit scores significantly impact loan options and interest rates available to primary residence buyers:

Excellent Credit (740+): Qualifies for best conventional mortgage rates and terms, potentially saving thousands annually compared to alternative loan products.

Good Credit (680-739): Access to competitive conventional rates and favorable FHA terms with lower down payment options.

Fair Credit (620-679): FHA loans provide excellent value with flexible qualification requirements and reasonable rates.

Credit Below 620: May require specialized lending programs, but options still exist for primary residence purchases.

Unlike DSCR loans, which often require minimum scores of 680-700, primary residence loans offer options for borrowers across the credit spectrum, often with better rates and terms.

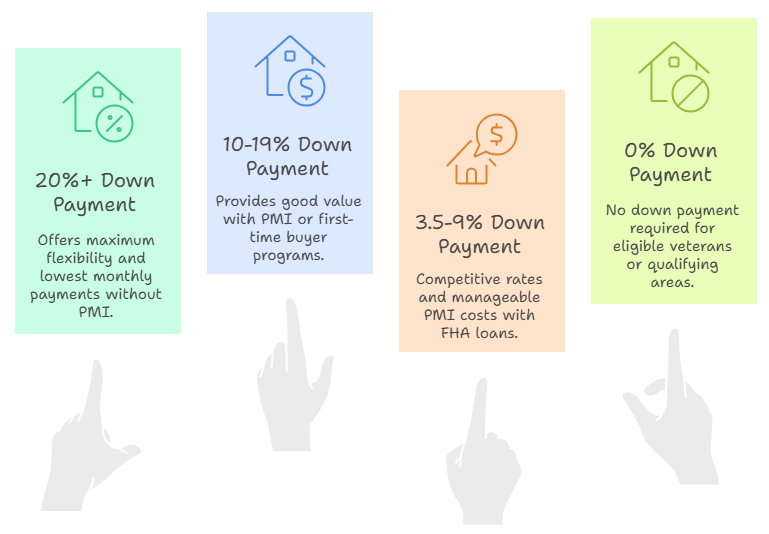

Down Payment Available and LTV Considerations

Available down payment significantly impacts loan options and overall cost of homeownership:

20%+ Down Payment: Conventional loans without PMI offer maximum flexibility and lowest total monthly payments.

10-19% Down Payment: Conventional loans with PMI or specialized first-time buyer programs provide good value.

3.5-9% Down Payment: FHA loans offer excellent terms with competitive rates and manageable PMI costs.

0% Down Payment: VA loans (for eligible veterans) or USDA loans (for qualifying areas) eliminate down payment requirements entirely.

Remember that DSCR loans typically require 20-25% down payment plus significantly higher interest rates, making them financially inferior even if they were legally appropriate for primary residences.

Long-term Homeownership Goals and Financial Planning

Consider long-term plans when selecting financing options:

5+ Year Ownership: Conventional mortgages offer the best overall value with competitive rates and flexible refinancing options.

Potential Relocation: Assumable FHA or VA loans provide future flexibility for buyers who may need to transfer ownership.

Home Improvement Plans: Renovation loan products combine purchase and improvement financing into single transactions.

Investment Conversion: If you eventually plan to convert your primary residence to rental property, understand that you’ll likely need to refinance with investment property financing at that time.

Understanding Investment Property Loans vs Primary Residence Financing

To fully understand why DSCR loans cannot be used for primary residences, it’s important to comprehend the fundamental differences between investment property loans and primary residence financing:

Investment Property Loan Characteristics

Investment property loans, including DSCR loans, are designed specifically for real estate investors purchasing rental properties to generate income. These loans evaluate the property’s income potential rather than the borrower’s personal financial situation.

Key Features of Investment Property Loans:

- Higher interest rates (typically 0.5-2% above primary residence rates)

- Larger down payment requirements (20-25% minimum)

- Stricter debt-to-income ratios for traditional investment loans

- Non-owner occupancy requirements

- Business purpose classification

- Focus on property cash flow and rental income

Primary Residence Loan Advantages

Primary residence loans are designed for homeowners who will live in the property as their main dwelling. These loans offer more favorable terms because owner-occupied properties historically have lower default rates.

Benefits of Primary Residence Financing:

- Lower interest rates than investment property loans

- Lower down payment options (as little as 0-3%)

- More flexible qualification requirements

- Access to government-backed loan programs

- No occupancy restrictions (you can live in your home)

- Better refinancing options and terms

The Role of Rental Income in DSCR Loans

DSCR loans rely entirely on rental income analysis to determine borrower qualification. Lenders evaluate:

- Current lease agreements and rental rates

- Market rent analysis from property appraisals

- Projected rental income based on comparable properties

- Property’s ability to generate positive cash flow

- Historical rental performance for existing properties

This rental income focus makes DSCR loans incompatible with primary residences, where homeowners live in the property instead of renting it to tenants.

Traditional Income Verification vs Property-Based Qualification

Understanding the difference between traditional income verification and property-based qualification helps explain why DSCR loans cannot work for primary residences:

Traditional Income Verification Process

Traditional loans for primary residences use comprehensive personal income verification:

- Employment verification and pay stub analysis

- Tax return review for self-employed borrowers

- Bank statement examination for deposit consistency

- Debt-to-income ratio calculations

- Personal credit history evaluation

- Asset verification for down payment and reserves

This process ensures borrowers have sufficient personal income to support mortgage payments regardless of property type or rental income potential.

Property-Based Qualification for Investment Loans

DSCR loans use property-based qualification that focuses entirely on the property’s income-generating ability:

- Market rent analysis and comparable property research

- Property appraisal including rental income assessment

- Debt service coverage ratio calculations

- Property cash flow projections

- Operating expense estimates for property management

This property-focused approach works only for investment properties that generate rental income, making it unsuitable for primary residences where owners live rather than rent.

Frequently Asked Questions About DSCR Loans and Primary Residences

Can I live in one unit of a duplex bought with a DSCR loan?

No, DSCR loans cannot be used for any property where you intend to live, including multi-unit properties where you would occupy one unit. Even if other units generate rental income, your occupancy violates the business purpose requirement. For owner-occupied multi-unit properties, consider conventional investment property loans designed specifically for this purpose.

What happens if I accidentally apply for a DSCR loan for my primary residence?

If discovered during underwriting, your application will be denied, and you’ll need to reapply for appropriate primary residence financing. If discovered after closing, you could face loan acceleration, legal action, and potential fraud charges. Always work with knowledgeable lenders who ensure you’re applying for appropriate loan products.

How long must I wait to convert an investment property to my primary residence?

Most lenders require at least 12 months of investment property ownership before allowing conversion to primary residence. However, if you purchased with a DSCR loan, you’ll likely need to refinance into a primary residence loan product to make this conversion legally and properly.

Are there any exceptions for multi-unit properties with DSCR loans?

While some flexibility exists for multi-unit properties in general lending, DSCR loans specifically cannot be used for any property where you intend to live. The business purpose requirement is absolute. Owner-occupied investment property loans through conventional or portfolio lenders are designed specifically for these situations.

What documentation proves primary residence versus investment property intent?

Lenders verify occupancy through utility connections, voter registration, driver’s license updates, insurance policies, and signed occupancy affidavits. Misrepresenting your intended occupancy constitutes fraud regardless of documentation provided. Always be truthful about intended property use during the application process.

Can DSCR loans be used for vacation rentals or short-term rentals?

Yes, DSCR loans can be used for vacation rental properties and short-term rental properties listed on platforms like Airbnb or VRBO, provided you don’t intend to use the property as your primary residence. The property must generate rental income and be used strictly for business purposes.

What if my financial situation changes after getting a traditional mortgage?

Traditional mortgages for primary residences don’t restrict your ability to change employment, start a business, or modify your financial situation. Unlike DSCR loans, which require ongoing rental income generation, primary residence loans only require continued mortgage payment capability.

How do interest rates compare between DSCR loans and primary residence loans?

DSCR loans typically carry interest rates 1-3% higher than primary residence loans due to increased risk profile and non-owner occupancy. For a $300,000 loan, this difference represents approximately $200-$500 monthly payment difference, making primary residence loans significantly more affordable.

Making the Right Choice: Primary Residence Financing

Choosing appropriate financing for your primary residence purchase requires careful consideration of your financial situation, long-term goals, and available options. While DSCR loans offer flexibility for real estate investors, they’re neither legal nor appropriate for primary residence purchases.

Working with Qualified Lending Professionals

The complexity of mortgage financing makes working with experienced local professionals essential for successful home purchases. Qualified loan officers understand the differences between investment property loans and primary residence financing, ensuring you apply for appropriate products.

Local lenders offer personalized service that large national lenders cannot match, including flexible underwriting for unique situations and detailed knowledge of local market conditions.

Understanding Total Cost of Homeownership

When evaluating financing options, consider total cost of homeownership beyond just interest rates:

- Principal and interest payments

- Property taxes and homestead exemptions

- Homeowners insurance costs

- Private mortgage insurance (if applicable)

- HOA fees and special assessments

- Maintenance and repair reserves

- Utility costs and energy efficiency

Building Long-Term Financial Success

Appropriate primary residence financing supports long-term financial success by:

- Building equity through homeownership

- Providing stable housing costs with fixed-rate loans

- Taking advantage of tax benefits for primary residences

- Creating foundation for future real estate investments

- Establishing credit history for future borrowing needs

Conclusion: Choose Legal, Appropriate Financing for Your Primary Residence

The question “Can you use a DSCR loan for a primary residence?” has a definitive answer: No. DSCR loans are exclusively designed for investment properties and cannot legally be used for homes you plan to live in. Attempting to do so violates federal regulations, loan terms, and can result in severe legal and financial consequences.

Homebuyers have access to numerous financing options specifically designed for primary residences that offer better terms, lower rates, and appropriate legal structure. Whether you choose conventional financing, FHA loans, VA loans, or specialized programs for self-employed borrowers, these options provide legal, appropriate paths to homeownership.

With balanced conditions and competitive financing options, the combination of available loan products and local market conditions creates excellent opportunities for homebuyers using appropriate financing products.

Don’t risk your financial future and legal standing by attempting to misuse investment property loans. Some areas offer competitive primary residence financing options that provide better value, lower costs, and proper legal protection for your homeownership dreams.

Understanding the difference between investment property loans and primary residence financing ensures you make informed decisions that support your long-term financial success while complying with all applicable laws and regulations.