Buying a home in Texas can seem like a far-off dream, especially with the average home price now over $335,000. That means a traditional 20% down payment would cost more than $67,000, which isn’t easy to set aside for most buyers.

Thankfully, FHA loans make homeownership more affordable. With down payments starting at just 3.5%, these government-backed loans offer a realistic path to owning a home in Texas.

Whether you’re buying your home for the first time in San Antonio, growing your family in Austin, or moving to Houston for work, you need to know the FHA loan requirements in the Lone Star State to navigate its competitive housing market.

In 2025, you can take advantage of these lending benefits:

- updated Texas FHA loan limits

- enhanced payment assistance programs

- more support for Texas homebuyers

You don’t have to do this alone. We’ll walk you through everything you need to know about qualifying for an FHA loan in Texas.

In this guide, we’ll cover credit score requirements, income guidelines, and loan limits by county. You’ll also learn about down payment assistance programs available across the state that can help make your home purchase even more affordable.

What is an FHA Loan in Texas?

An FHA loan is a mortgage loan that is insured by the Federal Housing Administration, a government agency under the U.S. Department of Housing and Urban Development (HUD). The Federal Housing Administration provides mortgage insurance on loans made by FHA-approved lenders, making them an attractive option for Texas homebuyers who may have lower credit scores or limited savings for a down payment.

These government-backed mortgages are designed to make homeownership more accessible, especially for individuals who may not qualify for conventional loans due to their credit score or debt to income ratio. Since their inception in 1934, more than 40 million people have used these mortgages to become homeowners.

For Texas homebuyers specifically, FHA loans offer particular advantages in our state’s dynamic housing market. Texas FHA loans are ideal for borrowers who may have lower credit scores, and are often preferred by consumers interested in buying their first homes.

Why Choose FHA Loans for Texas Homebuyers

The Federal Housing Administration originally created the FHA loans in 1934 to make homeownership accessible for people with lower income. The FHA is part of the U.S. Department of Housing and Urban Development (HUD), and the loans it backs are insured by the federal government.

This means if a borrower can’t pay back the loan, the government helps protect the lender. FHA loans are a popular choice for first-time homebuyers because they offer lower down payments and more flexible credit requirements.

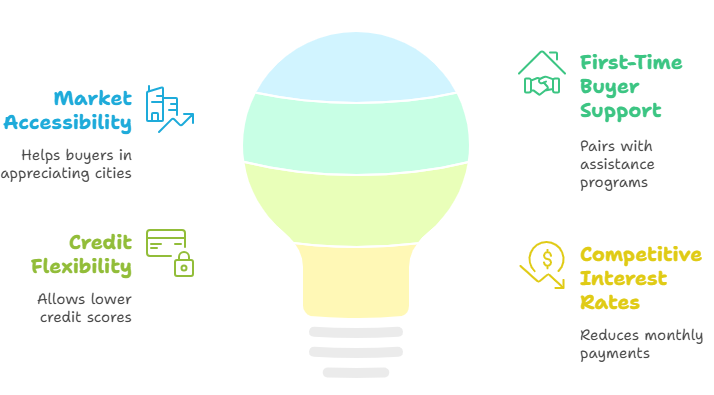

In Texas specifically, these loans serve several key purposes:

Market Accessibility: Texas cities like Austin, San Antonio, and Houston have seen rapid appreciation, making conventional loan requirements increasingly difficult to meet.

First-Time Buyer Support: With 89% of Texas payment assistance programs actively funded, FHA loans pair perfectly with state and local assistance programs.

Credit Flexibility: Texas FHA lenders report that FHA loans help qualified borrowers with credit scores as low as 580 access homeownership, though some lenders accept credit scores as low as 550.

Competitive Interest Rates: FHA mortgage loans in Texas come with competitive interest rates, which can reduce your monthly mortgage payment compared to other home loan options available to borrowers with less than perfect credit.

FHA Loan Requirements Texas: Credit Score Requirements

To qualify for an FHA loan and its low down payment of around 3.5%, you need to have at least a 580 FICO score. A credit score lower than 580 will require you to make a 10% down payment.

Minimum Credit Score for FHA Loans in Texas

580+ Credit Score Benefits:

- Minimum 3.5% down payment required

- Access to most competitive FHA rates available

- Simplified approval process with most FHA approved lenders

- Eligible for most Texas payment assistance programs

500-579 Credit Score Requirements:

- Minimum 10% down payment required

- Higher interest rates typically offered by mortgage lenders

- Additional documentation may be required during the FHA loan application process

How Texas FHA Lenders Vary in Credit Requirements

While the Federal Housing Administration sets minimum credit score requirements, individual mortgage lenders may have their own standards:

- Credit Unions: Often 580 minimum, with member benefits

- National Lenders: Typically 580-620 range depending on other factors

- Local Texas Banks: May offer flexibility with compensating factors

- Online Lenders: Generally stick to FHA guidelines minimums

Improving Your Credit Score for Texas FHA Loans

If you’re a Texas homebuyer who want to improve credit standing, you need to:

Pay Down Existing Debt: Focus on credit card balances first, as these impact your debt to income ratio calculations.

Monitor Your Credit Report: Begin by making all your payments on time and reducing any outstanding debts. This demonstrates your financial responsibility to potential FHA lenders.

Avoid New Credit: Resist opening new credit accounts during the FHA loan application process.

Consider HUD Counseling: Texas offers free housing counseling services through HUD approved housing counselor agencies.

FHA Down Payment Requirements and Minimum Down Payment Options

One of the most attractive features of FHA loans is the low minimum down payment requirement, often as low as 3.5% of the purchase price. Take a look at the details below.

Minimum Down Payment by Credit Score

For Credit Scores 580 and Above:

- Minimum down payment of 3.5% of the purchase price or appraised value

- Can be sourced from personal savings, gifts, or payment assistance programs

For Credit Scores 500-579:

- Minimum down payment of 10% of the purchase price required

- Higher down payment compensates for lower credit score risk

Down Payment Calculations for Major Texas Cities

Based on 2024 median home prices across major Texas markets, here’s what you can expect to pay:

In San Antonio, with a median home price of $285,000, a 3.5% down payment would be $9,975, while a 10% down payment would be $28,500.

In Austin, with a median price of $525,000, a 3.5% down payment would be $18,375, and a 10% down payment would be $52,500.

In Houston, with a median price of $320,000, a 3.5% down payment would be $11,200, and a 10% down payment would be $32,000.

In Dallas, with a median price of $425,000, a 3.5% down payment would be $14,875, and a 10% down payment would be $42,500.

Acceptable Down Payment Sources for FHA Loans

Your FHA lender is required to verify the source of all down payment funds. The down payment can come from:

Personal Savings: Most common source, requiring 2-3 months of bank statements

Gift Funds: From family members, employers, or charitable organizations

Payment assistance programs: Texas state and local programs

401(k) Loans: Allowed with proper documentation

Sale of Assets: Stocks, bonds, or other property with clear documentation

Gift Money Rules for Texas FHA Loans

You can use gift money from friends or family to help pay for your down payment when buying a home. You don’t have to pay taxes on the financial gift. But in 2025, if an individual gives you more than $19,000 or a married couple gives more than $38,000, they might have to pay a gift tax.

Texas gift fund requirements include:

- Gift letter documenting the relationship and gift amount

- Proof of donor’s ability to give the gift

- Clear paper trail showing fund transfer

- No expectation of repayment from the recipient

Texas Down Payment Assistance Programs for FHA Borrowers

Texas offers some of the nation’s most comprehensive payment assistance programs, with 89% of down payment assistance programs funded as of the fourth quarter of 2024. These programs can significantly reduce your out-of-pocket costs when combined with FHA loans.

Statewide Texas Payment Assistance Programs

Homes for Texas Heroes Program This program is for teachers, fire fighters and EMS personnel, police and correctional officers, and veterans. Benefits include:

- Down payment assistance up to 5% of loan amount

- Below-market interest rates for qualified borrowers

- Grant funds that don’t require repayment

- Available statewide with FHA, VA, or USDA loans

My First Texas Home Program The My First Texas Home program offers up to 5% of the loan amount in down payment and closing cost assistance for first-time homebuyers. Key features:

- Available to first-time homebuyers and veterans

- No-interest deferred loan structure

- Forgiven if you remain in home for specified period

- Compatible with FHA financing

My Choice Texas Home Program Designed for repeat buyers, this program offers:

- Up to 5% down payment assistance

- Available to any qualified homebuyer

- Flexible income requirements

- Statewide availability for FHA borrowers

Home Sweet Texas Home Program Good for low- and middle-income households, offering:

- Deferred forgivable second liens

- Income-based qualification requirements

- Up to 5% assistance on loan amount

Major City Payment Assistance Programs

Austin Down Payment Assistance The city offers up to $40,000 in assistance for both down payment and closing costs through a forgivable loan. For a single-person household, the income must not exceed $55,400.

Houston Homebuyer Assistance Program The City of Houston Housing and Community Development offers a DPA program available to those with a household income at or below 80% of the area’s median income and can offer up to $50,000.

Dallas and San Antonio Programs Both cities provide financial assistance to low- and moderate-income homebuyers when purchasing a home within city limits, with various programs offering $15,000 to $30,000 in assistance.

How Payment Assistance Programs Work with FHA Loans

Most payment assistance programs can be combined with FHA loans. They typically require income verification at or below 80% of Area Median Income, completion of homebuyer education through HUD approved housing counselor courses, minimum 620 credit scores for most programs, ensuring the property is within program boundaries, and often require first-time buyer status.

Debt to Income Ratio Requirements for Texas FHA Loans

FHA loans allow for higher debt to income ratios compared to conventional loans. The debt to income ratio must be 50 percent or less based on the borrower’s overall credit profile, though some Texas FHA lenders allow ratios up to 57% with compensating factors.

Front-end DTI covers housing expenses and should not exceed 31% of gross monthly income. This includes principal, interest, taxes, insurance, and HOA fees. You may be able to get approved with as high as 46.99 percent with compensating factors.

Back-end DTI covers total monthly debt payments and should not exceed 43% of gross monthly income typically. You may be able to get approved with as high as 56.99 percent depending on the lender. This includes all monthly debt obligations including credit cards, student loans, and car payments.

DTI Calculation Examples for Texas FHA Borrowers

Example: Moderate Income Borrower

- Monthly Gross Income: $6,000

- Maximum Housing Payment (31%): $1,860

- Maximum Total Debt (43%): $2,580

- Remaining for other monthly debt payments: $720

Compensating Factors for Higher DTI Ratios

Texas FHA lenders may approve borrowers with higher debt to income ratios when compensating factors are present. These include:

- Large Cash Reserves: 2+ months of mortgage payments in savings

- Minimal Increase in Housing Payment: Moving from rent to similar monthly payments

- Strong Credit History: No late payments in past 12 months

- Stable Employment: Same employer for 2+ years with steady income

Income and Employment Requirements for FHA Loans in Texas

Texas FHA loan borrowers must have verifiable, steady, and consistent income. You will need documentation to prove how much money you earn, and this requirement is the same for borrowers who are employees as well as those who are self-employed. FHA lenders typically require a minimum of two years employment history.

Employment History Documentation Requirements

W-2 Employees:

- 2 years of W-2 forms from current and previous employers

- Most recent pay stubs covering 30 days of income

- Verification of employment from current employer

- If job gaps exist, explanation letters required

Self-Employed Borrowers:

- 2 years of personal tax returns with all schedules

- 2 years of business tax returns (if applicable)

- Current profit and loss statements

- Bank statements showing business income deposits

Acceptable Income Sources for Texas FHA Loans

Texas FHA lenders accept various income types:

- Base Salary or Hourly Wages: Most stable income source

- Commission Income: 2-year average required for qualification

- Bonus Income: 2-year history required

- Social Security or Disability Income: Acceptable with proper documentation

- Rental Income: With property management experience

- Alimony or Child Support: With 3+ years remaining on court orders

- Military Allowances and Benefits: For active duty and veteran borrowers

Texas FHA Loan Limits 2025 by County

FHA loan limits in Texas range from $524,225 for a single-family home in most counties to $571,550 in more expensive areas. These Texas FHA loan limits determine the maximum loan amount you can borrow with an FHA loan in different parts of the state.

Standard vs High-Cost Area Limits

Standard Limit Counties ($524,225): Most Texas counties fall under the standard FHA loan limit, including:

- Bexar County (San Antonio) – $524,225

- Dallas County (Dallas) – $524,225

- Harris County (Houston) – $524,225

- Tarrant County (Fort Worth) – $524,225

- El Paso County (El Paso) – $524,225

High-Cost Area Counties ($571,550): These limits apply to counties with significantly higher median home prices:

- Travis County (Austin): $571,550

- Williamson County (Cedar Park, Round Rock): $571,550

- Hays County (Kyle, San Marcos): $571,550

- Midland County: $571,550

Multi-Unit Property Loan Limits

For investors or homebuyers interested in multi-unit properties as primary residences:

Standard Counties:

- 2-Unit Properties: $671,200

- 3-Unit Properties: $811,050

- 4-Unit Properties: $1,008,300

High-Cost Counties:

- 2-Unit Properties: $731,700

- 3-Unit Properties: $884,500

- 4-Unit Properties: $1,099,950

What to Do When Home Prices Exceed FHA Loan Limits

If the home price exceeds the Texas FHA loan limits for your county:

Increase Down Payment: Cover the difference with additional down payment funds Consider Conventional Loans: Higher limits but stricter qualification requirements Look in Adjacent Counties: Some neighboring counties may have different loan limits Negotiate Purchase Price: Work with seller to reduce price to within FHA loan limits

FHA Property Requirements and Appraisal Standards

The home you purchase with an FHA loan must be your primary residence. Before you can close on your new home, it will need to undergo an FHA appraisal by an FHA-approved appraiser.

Primary Residence Requirements

The FHA primary residence rule includes:

- Must occupy the property within 60 days of closing

- Cannot be purchased as investment property or second home

- Must live in property for at least one year as primary residence

- If multi-unit property, must occupy one unit as primary residence

FHA Property Standards and Appraisal Process

Before you can get an FHA loan, the home must go through an FHA appraisal. This checks that the home’s value matches the loan amount and that it meets the FHA’s basic safety and condition standards.

Key Property Requirements:

- Structural Integrity: Sound foundation, roof, and load-bearing elements

- Safety Systems: Working electrical, plumbing, and heating systems

- Health and Safety: No lead paint hazards, proper ventilation

- Access and Egress: Safe entry and exit routes from all levels

- Pest Control: No active termite infestations

Common Texas Property Issues

Texas-specific concerns that may affect FHA appraisal approval:

Foundation Issues: Common in expansive clay soil areas, especially Dallas-Fort Worth region Flood Zone Compliance: Especially important in Houston and coastal areas HVAC Systems: Must adequately heat and cool for Texas climate extremes Swimming Pools: Must meet safety requirements with proper barriers Septic Systems: Common in rural Texas areas, must be properly functioning

Manufactured Homes and Condominiums

FHA-Approved Condominiums:

- Building must be on FHA-approved condo list maintained by HUD

- Owner-occupancy ratios must meet FHA standards

- HOA finances must be stable with adequate reserves

- No ongoing litigation against HOA

Manufactured Homes in Texas:

- Must be built after June 15, 1976 to meet HUD construction standards

- Permanently affixed to owned land with proper foundation

- Must have proper tie-downs per Texas regulations

FHA Mortgage Insurance Premium (MIP) Costs

All FHA loans require mortgage insurance, which protects the lender in case of default. FHA borrowers must pay a mortgage insurance premium (MIP) each month as collateral. There are two types of MIP associated with FHA loans: upfront mortgage insurance premium and annual MIP.

Upfront Mortgage Insurance Premium (UFMIP)

All FHA loans require an upfront mortgage insurance premium (MIP). This is a one-time fee of 1.75% of the loan amount. This upfront mortgage insurance premium can be:

- Paid in cash at closing

- Financed into the loan amount (most common option)

- Combination of cash payment and financing

UFMIP Calculation Examples for Texas:

- $200,000 FHA loan: $3,500 UFMIP

- $300,000 FHA loan: $5,250 UFMIP

- $400,000 FHA loan: $7,000 UFMIP

- $500,000 FHA loan: $8,750 UFMIP

Annual Mortgage Insurance Premium

Borrowers must pay an annual mortgage insurance premium. This is added to your monthly mortgage payment. For most FHA borrowers in Texas, the annual MIP is 0.55% of the loan amount per year.

2025 Annual MIP Rates:

- 0.55% for loans ≤ $625,500 with LTV > 95%

- 0.50% for loans ≤ $625,500 with LTV ≤ 95%

- 0.75% for loans > $625,500 with LTV > 95%

- 0.70% for loans > $625,500 with LTV ≤ 95%

Monthly MIP Payment Examples

Austin Home Purchase Example:

- Purchase Price: $400,000

- Down Payment (3.5%): $14,000

- Loan Amount: $386,000

- Annual MIP (0.55%): $2,123

- Monthly MIP: $177

MIP Removal Options for Texas FHA Borrowers

If you put down at least 10% when you bought your home, you may be able to remove your MIP after 11 years. This option is available to many recent FHA borrowers in Texas.

MIP Removal Rules:

- 10%+ Down Payment: MIP automatically removed after 11 years

- Less than 10% Down: MIP required for life of loan

- Refinancing Option: Can refinance to conventional loan to remove MIP when reaching 20% equity

FHA Streamline Refinance Options in Texas

If you already have an FHA loan, you might qualify for an FHA streamline refinance. This program helps you get a lower interest rate or reduce your monthly payment.

Benefits of FHA Streamline Refinance

Reduced Documentation: Limited paperwork required compared to traditional refinancing No Appraisal Required: In most cases, no new home appraisal needed Lower Interest Rates: Access to current market rates Reduced Monthly Payments: Can significantly lower monthly mortgage payments Fast Processing: Streamlined approval process

FHA Streamline Refinance Requirements

To qualify for an FHA streamline refinance in Texas:

- Must currently have an FHA loan in good standing

- Must have made at least 6 monthly payments on current FHA loan

- No late payments in past 12 months

- Must demonstrate net tangible benefit

- Cannot take cash out of the transaction

Net Tangible Benefit Requirements

The FHA requires that borrowers receive a net tangible benefit:

- Rate Reduction: At least 0.5% reduction in interest rate for fixed-rate to fixed-rate refinance

- Payment Reduction: Minimum 5% reduction in principal and interest payment

- ARM to Fixed: Any reduction when moving from adjustable rate to fixed rate mortgage

Comparing FHA vs Conventional Loans in Texas

Understanding when to choose FHA versus conventional financing can save Texas homebuyers thousands of dollars. FHA loans allow lower credit scores and are easier to qualify for, while conventional loans offer more flexibility in certain situations.

Credit Score and Down Payment Comparison

FHA Loan Requirements:

- Minimum 580 for 3.5% down payment

- Minimum 500 for 10% down payment

- More forgiving of past credit issues

- Flexible gift fund sources allowed

Conventional Loan Requirements:

- Typically require 620-640 minimum credit score

- 3% minimum down payment for first-time homebuyers

- 20% down payment avoids private mortgage insurance

- More restrictive gift fund sources

Mortgage Insurance Comparison

FHA Mortgage Insurance:

- Upfront mortgage insurance premium of 1.75%

- Annual MIP of 0.55% typically

- Required for life of loan (with exceptions for 10%+ down payment)

- Cannot be removed without refinancing in most cases

Conventional Private Mortgage Insurance:

- No upfront premium required

- Monthly PMI typically 0.3% to 1.5% depending on credit score

- Automatically removed at 78% loan-to-value ratio

- Can be requested for removal at 80% LTV

When to Choose Each Loan Type

Choose FHA When:

- Credit score is between 580-680

- Want to minimize down payment (3.5%)

- Need flexible debt to income ratio allowances

- Qualify for Texas payment assistance programs

Choose Conventional When:

- Credit score is above 700

- Can put down 10-20% comfortably

- Want to remove mortgage insurance eventually

- Need to borrow above FHA loan limits

How to Apply for an FHA Loan in Texas

The FHA loan process in Texas is designed to be thorough but efficient.

Here’s a step-by-step guide.

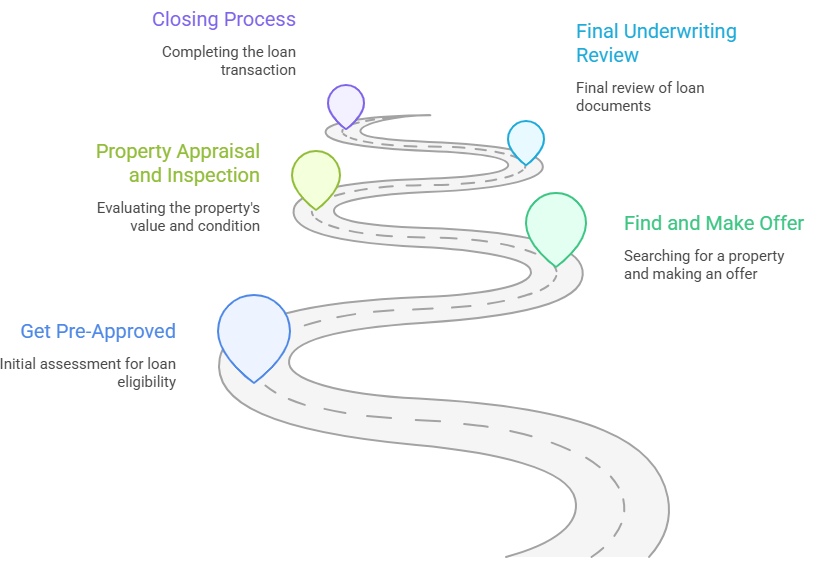

Step-by-Step FHA Loan Application Process

1. Get Pre-Approved (1-3 days)

- Complete loan application with FHA approved lender

- Submit required documentation for income and assets

- Receive pre-approval letter with maximum loan amount

2. Find and Make Offer (varies by market)

- Shop for homes within your budget and Texas FHA loan limits

- Work with a Texas real estate agent familiar with FHA loan requirements

- Submit offer with FHA financing contingency

3. Property Appraisal and Inspection (7-10 days)

- Lender orders FHA appraisal from approved appraiser

- Property must meet FHA minimum property standards

- Address any property condition issues identified

4. Final Underwriting Review (5-7 days)

- Underwriter reviews complete loan file for final approval

- May request additional documentation

- Final approval or conditional approval issued

5. Closing Process (1 day)

- Review and sign all loan documents

- Pay closing costs and down payment

- Transfer property ownership and receive keys

Required Documentation for Texas FHA Loans

Income and Employment Verification:

- 2 years of W-2 forms from all employers

- 30 days of pay stubs showing year-to-date earnings

- Employment verification letter from current employer

- If self-employed: 2 years of tax returns and current P&L statements

Asset and Down Payment Documentation:

- 2-3 months of bank statements for all accounts

- Investment account statements if applicable

- Gift letter and donor bank statements (if using gift funds)

- Payment assistance program award letters

Credit and Debt Information:

- Mortgage credit report (ordered by lender)

- Explanation letters for any credit issues

- Debt verification for student loans, car payments, and other monthly debt payments

Property Documentation:

- Fully executed purchase contract with all addenda

- Property disclosure statements from seller

- HOA documents and budgets (if applicable)

- Homeowner’s insurance binder and proof of payment

Timeline Expectations for Texas FHA Loans

Typical Texas FHA Loan Timeline:

- Pre-approval process: 1-3 business days with complete documentation

- House hunting period: Varies by local market conditions

- Contract to closing: 30-45 days for standard transactions

- Rush closings possible: 21-30 days with proper preparation

Frequently Asked Questions About Texas FHA Loans

Do you have to be a first-time buyer for an FHA loan in Texas?

FHA loans are not exclusively for first time homebuyers. Any borrower who meets the basic qualification criteria can take advantage of this program to purchase a home. However, being a first-time buyer may qualify you for additional Texas payment assistance programs.

Can you use an FHA loan for investment property in Texas?

No, FHA loans require that the borrower must intend to live in the home as their primary residence. The property must be your primary residence, and you must move in within 60 days of closing. FHA loans are not available for investment properties or second homes.

How long does FHA loan approval take in Texas?

Pre-approval usually takes 1 to 3 business days if you provide all the required documents. From application to closing, the full process typically takes 30 to 45 days.

What happens if the FHA appraisal comes in low in Texas?

If the appraisal is below the contract price, you have several options:

- Negotiate with the seller to reduce the price to appraised value

- Pay the difference in cash if you have available funds

- Request a reconsideration of value if you believe appraisal is incorrect

- Walk away from the purchase if you have an appraisal contingency

Can you refinance from FHA to conventional in Texas?

Yes, many Texas homeowners refinance from FHA to conventional loans to eliminate mortgage insurance once they have 20% equity in their home. This strategy can save hundreds of dollars monthly for qualified borrowers.

What Texas cities have the highest FHA loan limits?

Travis, Williamson, Hays and Midland counties have the highest Texas FHA loan limits at $571,550 for single-family homes. This includes Austin and surrounding areas where home prices are higher than the state average.

How much can you borrow with an FHA loan in Texas?

Texas FHA loan limits range from $524,225 for a single-family home in most counties to $571,550 in more expensive areas. The exact amount depends on your specific county, the number of units in the property, and your individual qualifications.

Can you get an FHA loan with student loans?

Yes, you can qualify for an FHA loan with student loans. If you are currently repaying your education loans, the lender considers your monthly payments when calculating debt to income ratio. If your student loans are currently deferred, the lender estimates your future monthly payments at 1% of the borrowed amount for DTI purposes.

Do FHA loans have prepayment penalties?

FHA loans do not charge penalties for paying off your loan early. You can make extra payments, pay off the loan faster, or refinance at any time without extra fees.