If you’re thinking about refinancing your mortgage in San Antonio or anywhere in Texas, you might come across something called “Points in Refinance”. These are fees you can pay upfront to lower your interest rate and potentially save money over time.

But how exactly do refinance points work? And are they worth the cost?

This easy-to-follow guide will break down:

- what discount points are

- how they affect your mortgage

- when paying for them might be a smart move

Whether you’re new to refinancing or just need a refresher, we’ll help you understand your options.

What Are Points in a Refinance?

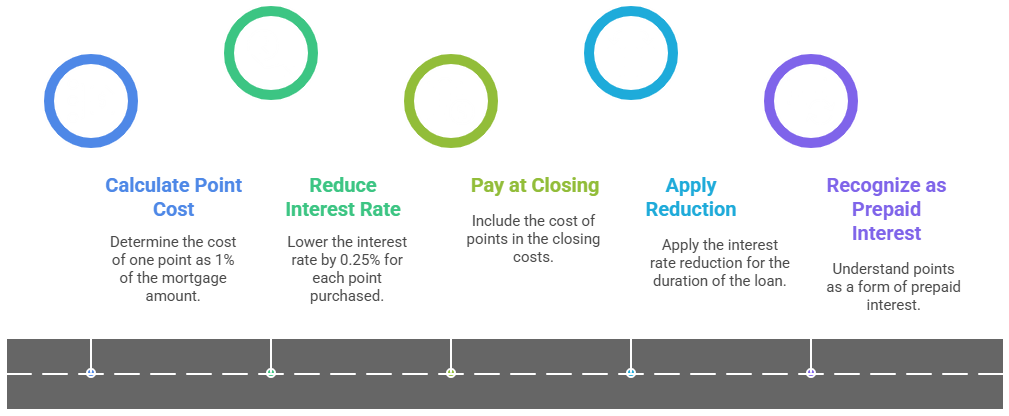

Refinance points, also called discount points, are upfront fees you pay to your mortgage lender at closing in exchange for a lower interest rate on your new mortgage. When you refinance a loan, you’re essentially replacing your existing mortgage with a new one, and discount points give you the opportunity to “buy down” your interest rate at closing.

Each mortgage point equals 1% of your total loan amount. For example, on a $300,000 refinance, one point would cost $3,000. In exchange for paying this upfront fee, you typically receive a 0.25% reduction in your interest rate, though the exact amount varies by lender and market conditions.

Key Facts About Refinance Points:

How Mortgage Points Work in Practice

Let’s look at real numbers and examine a typical Texas refinance scenario to illustrate the mechanics of buying points.

Example: Texas Refinance with Discount Points

Scenario: Sarah is refinancing her $250,000 mortgage in Austin. Her lender offers these options:

Option 1: No Points

- Loan Amount: $250,000

- Interest Rate: 6.75%

- Monthly Payment (P&I): $1,622

- Total Interest Over 30 Years: $333,920

Option 2: Buy 2 Points

- Points Cost: $5,000 (2% of $250,000)

- Interest Rate: 6.25% (reduced by 0.5%)

- Monthly Payment (P&I): $1,539

- Monthly Savings: $83

- Total Interest Over 30 Years: $304,040

Break-Even Calculation: $5,000 (cost of points) ÷ $83 (monthly savings) = 60 months (5 years)

Sarah would need to stay in her home for at least 5 years to benefit from buying mortgage points. If she keeps the loan for the full 30-year term, she’d save $29,880 in total interest ($333,920 – $304,040) minus the $5,000 cost of points, for a net savings of $24,880.

Understanding the Annual Percentage Rate (APR)

When comparing refinance offers, it’s important to understand that the annual percentage rate (APR) includes both the interest rate and the cost of points. A seemingly low interest rate might actually be higher when points are factored into the APR calculation. Always ask lenders for quotes both with and without points to make accurate comparisons.

When Should You Buy Discount Points on a Refinance?

Paying for discount points when refinancing depends on your personal financial goals and how long you plan to stay in your home. Here are the key scenarios where buying points is a good idea:

Ideal Candidates for Buying Mortgage Points

Long-Term Homeownership Plans The longer you plan to stay in your home, the more time you have to recoup the upfront cost of points through monthly savings on your mortgage payment. Most financial advisors recommend only buying points if you plan to stay in your home for at least 5-7 years beyond your break-even point.

Sufficient Cash Reserves After Closing Costs You should only consider points if you have adequate funds remaining after covering:

- All refinance closing costs

- Emergency fund requirements (3-6 months of expenses)

- Any other financial priorities

Desire for Lower Monthly Payments If reducing your monthly mortgage payment is a priority for budgeting purposes, points can help you achieve this goal. The reduced monthly payment from buying points can free up cash flow for other expenses or investments.

Stable Employment and Income Most lenders prefer borrowers with stable income when purchasing points, as it demonstrates your ability to both afford the upfront cost and maintain the ongoing mortgage payments.

Texas Market Considerations

Several factors make Texas particularly favorable for homeowners considering refinance points:

Housing Market Stability Texas markets like San Antonio, Austin, and Houston have shown consistent growth and stability, supporting longer-term homeownership decisions that make points more attractive.

No State Income Tax Texas residents don’t pay state income tax, which can make the upfront investment in points more affordable compared to high-tax states.

Growing Economy The state’s diverse economy provides employment stability that supports confident long-term housing decisions.

Calculating Your Break-Even Point

Before you decide to buy points, you need to calculate your break-even point. The break-even point tells you exactly how long you need to stay in your home to recover the cost of buying points.

Here’s a simple way to look at it:

The Break-Even Formula

Break-Even Period = Total Cost of Points ÷ Monthly Payment Savings

Let’s work through several examples using different loan amounts and point purchases:

Example 1: Conservative Approach

- Loan Amount: $200,000

- Points Purchased: 1 point ($2,000)

- Interest Rate Reduction: 0.25% (from 6.5% to 6.25%)

- Monthly Savings: $28

- Break-Even: $2,000 ÷ $28 = 71 months (about 6 years)

Example 2: Aggressive Strategy

- Loan Amount: $400,000

- Points Purchased: 2.5 points ($10,000)

- Interest Rate Reduction: 0.625% (from 7.0% to 6.375%)

- Monthly Savings: $152

- Break-Even: $10,000 ÷ $152 = 66 months (5.5 years)

Advanced Break-Even Considerations

Tax Implications Mortgage points are tax-deductible, but for refinances, they must typically be deducted over the life of the loan rather than in the first year. This affects your true break-even calculation.

Opportunity Cost Analysis Consider what else you could do with the money used for points:

- Investment returns in the stock market

- Paying off higher-interest debt

- Home improvements that add value

Interest Rate Environment In a declining rate environment, the value of points decreases if you’re likely to refinance again soon. Conversely, in a rising rate environment, locking in the lowest possible rate with points becomes more valuable.

When Points Don’t Make Sense in a Refinance

Sometimes, buying discount points doesn’t make financial sense. Here are a few situations where you might want to skip them:

Short-Term Ownership Plans

Plans to Sell or Relocate If you’re planning to sell your home within 3-5 years, you likely won’t have enough time to reach your break-even point. Common reasons for shorter-term ownership include:

- Job relocations

- Family changes (marriage, divorce, children)

- Retirement moves

- Lifestyle changes

Home Upgrade Plans If you’re planning to trade up to a larger home or move to a different area within the next few years, points may not provide enough time to pay for themselves.

Financial Constraints

Limited Cash Flow Never compromise your emergency fund or other essential financial needs to buy points. Ideal candidates for points have:

- 3-6 months of expenses in emergency savings after buying points

- No high-interest debt (credit cards, personal loans)

- Stable income and employment

Better Alternative Uses for Cash Consider whether the money used for points could generate better returns elsewhere:

- Paying off credit card debt (often 15-25% interest)

- Maxing out 401(k) contributions with employer matching

- Investing in home improvements that add value

Market Timing Factors

Expectation of Future Rate Declines If you believe mortgage rates will drop significantly in the next 2-3 years, you might want to skip points and plan to refinance again when rates are lower.

Planning Another Refinance If you’re considering a cash-out refinance in the near future or anticipate needing to refinance for other reasons, points on your current refinance may not be worthwhile.

Types of Points: Discount Points vs. Origination Points

Not all points are created equal. You need to understand the difference between discount points and origination points to assess refinance offers.

Discount Points (What We’ve Been Discussing)

Discount points are optional fees that reduce your interest rate. Key characteristics:

- Voluntary purchase

- Permanent rate reduction

- Typically 0.25% rate reduction per point

- Cost equals 1% of loan amount per point

- Can purchase fractional points (0.5, 1.5, etc.)

Origination Points

Origination points are fees some lenders charge to process and underwrite your loan. Important distinctions:

- May be required by the lender

- Do NOT reduce your interest rate

- Cover administrative costs and lender profit

- Also equal 1% of loan amount per point

- Not all lenders charge origination points

Reading the Fine Print

When comparing refinance offers, carefully review:

- Whether quoted rates include points

- If points are required or optional

- The total annual percentage rate (APR) which includes all fees

- Whether origination fees are separate from discount points

Refinance Points vs. Other Options

Before committing to buying points, consider alternative strategies that might better serve your financial goals. These include:

Alternative 1: No-Cost Refinancing

A no-cost refinance eliminates upfront fees but typically comes with a slightly higher interest rate. This option makes sense when:

- You have limited cash for closing costs

- You’re uncertain about long-term homeownership plans

- You want to preserve cash for other investments

Pros:

- No out-of-pocket closing costs

- Immediate monthly savings possible

- Preserves cash for other uses

Cons:

- Higher long-term interest costs

- May not offer the lowest possible rate

Alternative 2: Lender Credits

Lender credits work opposite to points—you accept a higher interest rate in exchange for the lender paying some of your closing costs.

When Lender Credits Make Sense:

- Limited cash for closing

- Planning short-term ownership

- Want to minimize upfront costs

Alternative 3: Larger Principal Payment

Instead of buying points, consider making a larger payment toward your principal balance:

Benefits:

- Reduces total loan amount

- Builds equity faster

- No need to reach a break-even point

- More flexible than points

Tax Implications of Mortgage Points

Let’s take a look at how the tax treatment of mortgage points can impact your decision and overall financial benefit.

Tax Deductibility Rules

For Refinances:

- Points are typically deducted over the life of the loan

- Must itemize deductions to claim the benefit

- Subject to mortgage interest deduction limits

Example Tax Calculation:

- $3,000 in points on 30-year refinance

- Annual deduction: $3,000 ÷ 30 = $100 per year

- If in 24% tax bracket: $24 annual tax savings

Internal Revenue Service Guidelines

The Internal Revenue Service has specific requirements for deducting mortgage points:

- Points must be clearly stated on your settlement statement

- Must be calculated as a percentage of loan amount

- Cannot exceed points commonly charged in your area

- Must use your own funds (not borrowed from lender)

Impact on Break-Even Calculation

When factoring in tax benefits, your effective break-even period may be shorter than the simple calculation suggests. Work with a tax professional to understand how points affect your specific situation.

Common Questions About Refinance Points

Here are some of the most common questions and straightforward answers to help you make an informed decision.

How Many Points Can You Buy?

Most lenders cap the number of discount points you can purchase, typically between 3-4 points. Some lenders may allow more points depending on:

- Your credit profile

- Loan amount and type

- Current market conditions

- Lender’s investor requirements

Can You Finance Points Into Your Loan?

Yes, if you have sufficient equity in your home, you can roll the cost of points into your new loan amount. However, this approach:

- Increases your total mortgage debt

- Means you’ll pay interest on the points over time

- May affect your loan-to-value ratio

- Could impact your interest rate

Are Points Negotiable?

While the cost of points is typically standardized (1% of loan amount), you may be able to negotiate:

- The interest rate reduction per point

- Combination deals with other fees

- Fractional point purchases

- Alternative fee structures

Do Points Affect PMI Requirements?

Buying points doesn’t directly affect private mortgage insurance requirements, which are based on your loan-to-value ratio. However, if rolling points into your loan increases your loan amount, it could affect your LTV ratio.

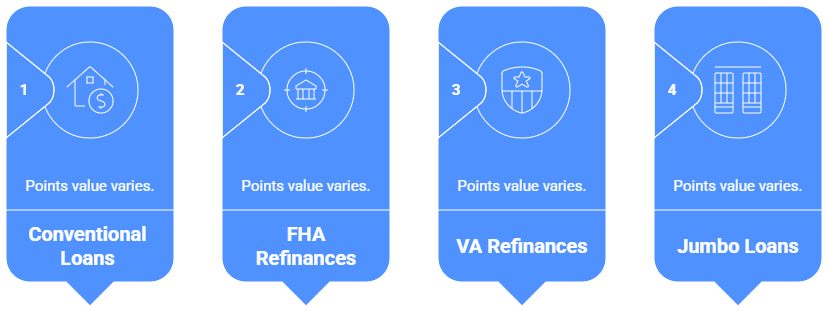

Mortgage Points and Different Loan Types

The value and availability of points can vary depending on your loan type. Here’s a breakdown:

Conventional Loans

Conventional loans offer the most flexibility with points:

- Can typically buy up to 4 points

- Flexible rate reductions

- Points are tax-deductible

- No restrictions on point purchases

FHA Refinances

FHA streamline refinances have specific point considerations:

- Limited documentation requirements

- Points may be restricted

- May not require appraisal

- Government-backed loan benefits

VA Refinances

VA Interest Rate Reduction Refinance Loans (IRRRL) offer unique advantages:

- No appraisal typically required

- Can finance points into loan

- No out-of-pocket costs in many cases

- Veteran-specific benefits

Jumbo Loans

High-balance loans may offer different point structures:

- Potentially larger rate reductions per point

- Higher overall point costs due to loan size

- More negotiating flexibility

- Portfolio lending considerations

Making Your Decision: A Step-by-Step Guide

If you’re unsure if paying points on your refinance is the right move, here’s an easy way to break it down:

Step 1: Calculate Your Numbers

- Determine total cost of points you’re considering

- Calculate monthly payment savings

- Find your break-even period using the formula

Step 2: Assess Your Timeline

- How long do you realistically plan to stay in your home?

- Consider job stability, family plans, and lifestyle goals

- Add a buffer to your break-even period for unexpected changes

Step 3: Evaluate Your Finances

- Ensure you have adequate emergency savings after points

- Consider alternative uses for the cash

- Factor in tax implications

Step 4: Consider Market Conditions

- Current interest rate trends

- Likelihood of future refinancing opportunities

- Economic factors affecting your local housing market

Step 5: Compare All Options

- Points vs. no points

- No-cost refinancing alternatives

- Lender credit options

- Different lenders and loan programs

Texas-Specific Considerations for Refinance Points

Refinancing in Texas comes with a few unique rules and conditions to keep in mind:

Texas Property Tax Implications

Texas has relatively high property taxes but no state income tax. This affects the overall cost of homeownership and may influence how long you plan to stay in your home.

Regional Market Conditions

Different Texas markets have varying characteristics:

- San Antonio: Stable, affordable market supporting longer-term ownership

- Austin: High growth but also high appreciation, potential for relocation

- Houston: Large job market with diverse opportunities

- Dallas: Corporate relocations common, consider job stability

State-Specific Programs

Texas offers several programs that could affect your refinancing decision:

- Texas State Affordable Housing Corporation programs

- Local down payment assistance programs

- Veterans land board programs

Working with Local Lenders

Local Texas lenders like South Texas Lending understand regional market nuances:

- Local economic factors

- Regional housing trends

- State-specific regulations

- Community banking relationships

Getting Started with Your Refinance

If you’re ready to move forward, here’s how to take the next step:

Shopping for Lenders

Compare offers from multiple lenders, including:

- Large national banks

- Regional banks and credit unions

- Mortgage brokers

- Online lenders

Questions to Ask Lenders

- What’s your interest rate with and without points?

- How much does each point reduce the rate?

- What are the total closing costs?

- Are there any origination points or fees?

- Can I get a rate lock while I decide?

Documentation You’ll Need

Prepare the refinance application process by gathering:

- Recent pay stubs and tax returns

- Bank statements and asset documentation

- Current mortgage statement

- Property tax and insurance information

Rate Lock Considerations

Once you decide on points, consider locking your rate to protect against increases while your refinance processes. Rate locks typically last 30-60 days, with extensions available for a fee.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Mortgage rates, terms, and program availability are subject to change. Individual circumstances vary, and you should consult with a qualified mortgage professional to determine the best refinancing strategy for your situation.

South Texas Lending (STX Lending) – Your trusted San Antonio mortgage experts. NMLS #[237341]. Licensed by the Texas Department of Savings and Mortgage Lending.