Do you have a home improvement project that you’ve been putting off? Do you need extra money to pay for major household expenses or consolidate your debts? Why not tap into your home equity to access funds?

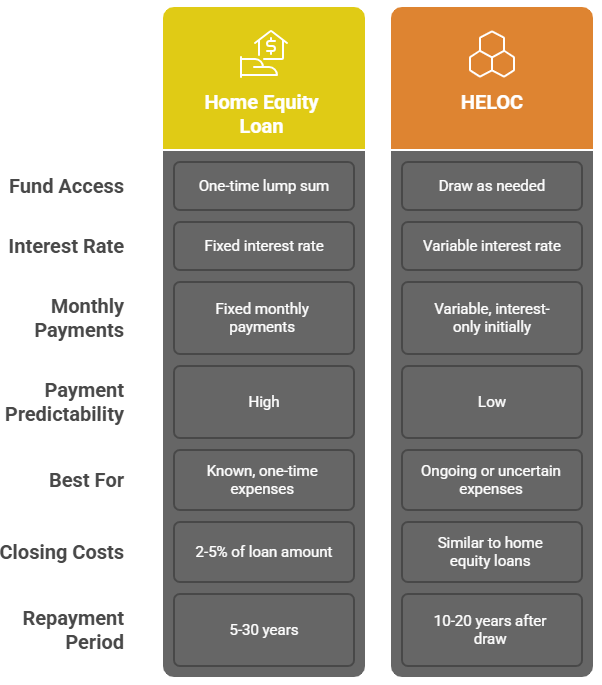

The good news is both home equity loans and home equity lines of credit (HELOCs) allow you to turn your home’s equity into cash that you can borrow, but there’s a slight difference in how these two financial tools work.

- A home equity loan provides a one time lump sum at a fixed interest rate.

- A HELOC works like a credit line, allowing you to borrow money as needed with variable interest rates.

Before you can take advantage of the equity you have in your home and know which option suits your needs, you have to be aware of the key differences between a home equity loan and a HELOC. And we’re here to help.

What Is Home Equity?

Home equity is the difference between your home’s current market value and the amount you owe on a mortgage loan you used to purchase the property.

Example: $400,000 (your home’s worth) – $250,000 (your outstanding loan balance) = $150,000 (your home equity)

Most lenders require you to maintain at least 15-20% equity in your home, meaning you can typically borrow up to 80-85% of your home’s appraised value. Your home serves as collateral for both loan types, which allows lenders to offer lower interest rates compared to personal loans or credit cards.

Home Equity Loan: The Lump Sum Option

A home equity loan is an installment loan that provides all funds upfront in a single disbursement. You receive exactly how much money you requested at closing and then make fixed monthly payments over a set period, typically 5 to 30 years.

How Home Equity Loans Work

When you take out a home equity loan, you’ll receive the full loan amount at closing. From day one, you’ll make fixed monthly payments that include both principal and interest. The interest rate remains the same throughout the entire repayment period, making it easy to budget for your monthly payments.

Home Equity Loan Pros

Predictable payments: Fixed interest rate means your monthly payment stays the same for the life of the loan, making budgeting straightforward.

Lower interest rates: Secured by your home, these loans typically offer significantly lower rates than credit cards or personal loans.

Immediate access to cash value: Receive all funds at closing to pay off debts or finance home improvements right away.

Potential tax benefits: Interest may be tax-deductible when used for qualifying home improvements.

Home Equity Loan Cons

Pay interest on full amount: You’ll pay interest on the entire loan balance from day one, even if you don’t need all the money immediately.

Less flexibility: Once you receive the lump sum, you can’t borrow additional funds without applying for a new loan.

Closing costs: Expect to pay 2-5% of the loan amount in fees, including appraisal and origination costs.

Home at risk: Your property serves as collateral, meaning default could result in foreclosure.

HELOC: The Flexible Credit Line

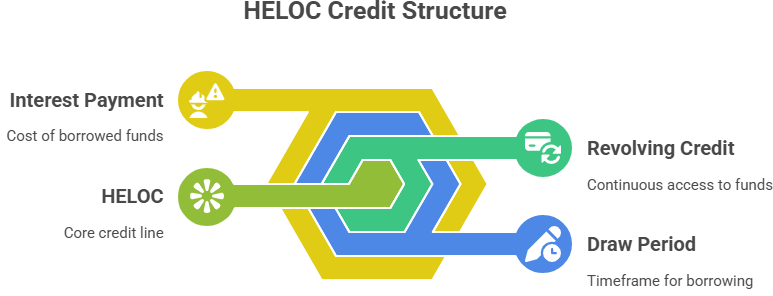

A HELOC (home equity line of credit) functions as a revolving line of credit, similar to a credit card. You can access funds as needed during the draw period and only pay interest on what you actually borrow.

How HELOCs Work

HELOCs operate in two phases:

Draw Period (typically 10 years): During this time, you can borrow up to your credit limit as needed. Many lenders allow interest-only payments during this period, though paying toward principal is advisable.

Repayment Period (usually 10-20 years): Once the draw period ends, you enter the repayment period where you can no longer withdraw money. Monthly payments now include both principal and interest until the balance is paid off.

HELOC Pros

Ongoing access to funds: Borrow only what you need, when you need it, up to your credit limit.

Pay interest only on amount used: Unlike home equity loans, you’re only charged interest on your outstanding balance, not the full credit limit.

Lower initial payments: Interest-only payments during the draw period can help manage cash flow.

Flexibility for unexpected costs: Perfect for ongoing projects or emergency expenses where timing and amounts are uncertain.

HELOC Cons

Variable interest rate: Most HELOCs have adjustable interest rates that can increase your monthly payments over time.

Payment shock risk: When the repayment period begins, monthly payments can jump significantly if you’ve only been making interest payments.

Temptation to overborrow: Easy access to funds can lead to spending more than necessary.

Annual fees: Some lenders charge maintenance fees or other ongoing costs.

Home Equity Loan vs HELOC: Key Differences

Which Option Is Better for Debt Consolidation?

Both options can be effective for consolidating debt, but the right choice depends on your specific financial situation and debt-to-income ratio.

Let’s compare both options.

Home Equity Loan for Consolidating Debt

A home equity loan works well when you know the exact amount of debt you want to consolidate. You can pay off all credit cards and high-interest debts immediately, then focus on one fixed monthly payment. This simplifies payments and potentially lowers interest rates.

Example: If you have $30,000 in credit card debt at 24% APR, consolidating with a home equity loan at 8% could save you hundreds in monthly interest payments.

HELOC for Debt Consolidation

A HELOC may be better if you have varying debt amounts or want the flexibility to pay off debts strategically over time. The ability to make interest-only payments initially can provide breathing room while you organize your finances.

Important consideration: Both options convert unsecured debt into secured debt. Your home becomes collateral, so ensure you can afford the new payments before proceeding.

Qualification Requirements

Both home equity loans and HELOCs have similar qualification requirements:

Home equity: At least 15-20% equity in your home (80-85% combined loan-to-value ratio maximum)

Credit score: Most lenders require 620 minimum, though 700+ gets better rates

Debt-to-income ratio: Typically 43% or lower, including the new loan payment

Stable income: Proof of employment and ability to repay through pay stubs, tax returns, and other documentation

Property appraisal: Lenders require a professional appraisal to determine your home’s current value

Current Interest Rates and Market Conditions

As of June 2025, average rates are:

- HELOC rates: 8.27% (variable)

- Home equity loan rates: 8.24% (fixed)

- Credit cards: Over 20% average

- Personal loans: Around 12.65% average

Market predictions suggest HELOC rates may continue to drop in 2025, potentially averaging 7.25%. These forecasts make both options great alternatives to higher-rate debt.

When to Choose a Home Equity Loan

Consider a home equity loan if you:

- Need a specific, known amount for a one-time expense

- Prefer predictable monthly payments for budgeting

- Want protection from rising interest rates

- Are consolidating a fixed amount of debt

- Plan to finance home improvements with a clear budget

When to Choose a HELOC

A HELOC might be better if you:

- Need ongoing access to funds over time

- Want flexibility in borrowing amounts

- Can manage variable interest rates and payments

- Have projects with uncertain costs or timing

- Want to use it as an emergency fund backup

Application Process and Timeline

The approval process for both options typically takes 30-60 days and includes:

- Application and documentation (1-3 days)

- Credit and income verification (5-10 days)

- Home appraisal (7-14 days)

- Underwriting and approval (10-21 days)

- Closing (1 day)

You’ll need to provide pay stubs, tax returns, mortgage statements, and other financial documentation. Lenders will also ask for property insurance and, depending on your location, flood insurance.

Important Risks to Consider

Both loan types use your home as collateral, creating significant risks:

Foreclosure risk: Missing payments could result in losing your home

Market risk: If home values decline, you could owe more than your home is worth

Rate risk (HELOCs): Variable rates can increase your payment burden

Temptation risk: Easy access to funds can lead to overspending

Alternatives to Consider

Before choosing either option, consider these alternatives:

Cash-out refinance: Replace your existing mortgage with a larger loan to access equity

Personal loans: Unsecured loans that don’t risk your home

401(k) loans: Borrow against retirement savings (if available)

Credit cards: For smaller amounts or short-term needs

Making Your Decision

The choice between a home equity loan and HELOC depends on your specific needs:

Choose a home equity loan for predictable payments, known borrowing amounts, and protection from rate increases.

Choose a HELOC for flexibility, ongoing access to funds, and lower initial payments.

Both options provide access to your home’s cash value at competitive rates, but they serve different financial strategies. The choice boils down to your borrowing needs, risk tolerance, and financial goals.

Keep in mind, though, that you’ll be using your home as a collateral, so you should only borrow what you can comfortably afford to repay. Talk to a financial expert to weigh in the best options for your unique financial situation and long-term goals.