Most mortgage pre approval letters are valid for 60 to 90 days, though that can vary by lender. Some lenders offer periods as short as 30 days or as long as 120 days.

So, what does a mortgage preapproval letter mean for you and your home buying journey?

It’s a useful document to have on hand before you start the house hunting process, especially in today’s competitive real estate market.

A pre-approval from a lender for a mortgage shows that you’re serious about buying a home and can actually afford it, making negotiations and transactions with home sellers and real estate agents a smoother process.

Quick Answer: How Long Is a Pre Approval Good For?

Bottom Line: Mortgage pre approval typically lasts 60 to 90 days. When your pre approval expires, you’ll need to provide updated financial documents like recent pay stubs and bank statements, and your mortgage lender may perform another hard credit pull.

Key takeaways:

- Standard timeframe is 2-3 months depending on the lender

- Pre approval expiration date is clearly stated on your preapproval letter

- You can renew or extend before expiration with updated documentation

- Timing your application when you’re ready to start shopping is crucial

What Is Mortgage Pre Approval?

Mortgage preapproval is a lender’s conditional commitment to provide you with a home loan up to a specific amount based on a thorough review of your financial situation. Unlike mortgage prequalification, which is an estimate based on self-reported information, the preapproval process requires verification of your credit score, income, employment status, and financial documents.

During the mortgage preapproval process, your mortgage lender will:

- Review your credit history and credit report

- Verify your income with recent pay stubs and tax returns

- Analyze your debt to income ratio

- Examine your bank statements and financial documents

- Calculate how much you can comfortably afford for a home purchase

The result is a preapproval letter that shows sellers you’re pre approved for a specific loan amount and are a serious buyer ready to move forward with a purchase contract.

How Long Does Mortgage Pre Approval Last?

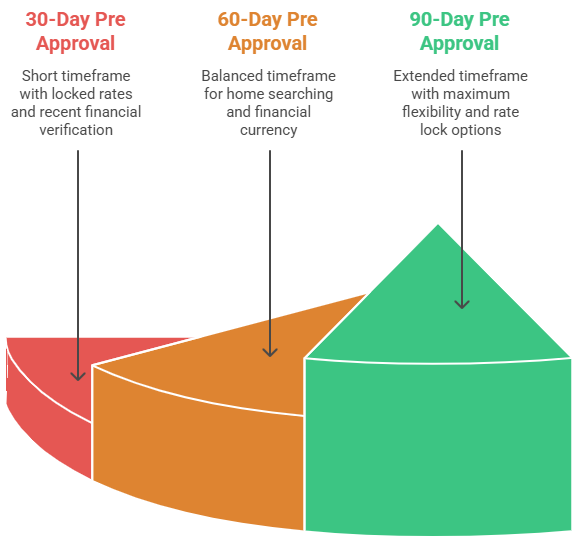

Each lender sets its own time limit, but 60 to 90 days are the standard. Here’s what you can expect from different timeframes:

30-Day Pre Approval

Some mortgage lenders issue pre approval letters with 30-day expiration dates, particularly in fast-moving markets. While this provides less time for house hunting, it often comes with locked interest rates and demonstrates recent financial verification.

60-Day Pre Approval

The most common timeframe across the mortgage industry. This provides sufficient time for home searching while ensuring your financial information remains current. Most lenders consider this the optimal balance between buyer flexibility and lender risk management.

90-Day Pre Approval

Offered by many major lenders including Bank of America and Rocket Mortgage. This extended timeframe gives you maximum flexibility for your home search and often includes rate lock options for the full period.

The pre approval expiration date will be clearly stated on your mortgage preapproval letter, so you’ll know exactly when you need to renew or extend your approval.

Factors That Affect How Long Your Pre Approval Is Good For

If the issuing of your mortgage pre approval is taking longer than usual, don’t panic. A pre approval requires an in-depth look into your qualifications, which could take some time.

Having said that, there are other factors that can affect the duration of your pre approval processing. These include:

Credit Report Validity

Credit reports are valid for 120 days, and many mortgage lenders set your pre approval expiration date based on this timeline. Since your credit score and credit history are crucial factors in the mortgage process, lenders want current information when you’re ready to make an offer.

Changes in Your Financial Situation

Your mortgage pre approval is based on a snapshot of your finances at the time of application. Significant changes in your employment status, income, or debt levels can affect your approval status, which is why lenders limit validity periods.

Interest Rate Fluctuations

Market conditions and interest rate changes can impact your loan terms. If rates rise significantly during your pre approval period, you may no longer qualify for the same loan amount, affecting your purchasing power.

Lender Policies and Loan Terms

Different mortgage lenders have varying policies for pre approval validity. Some offer extensions, while others require complete reapplication. Your specific loan officer can explain their lender’s renewal process.

What Happens When Your Mortgage Pre Approval Expires

If your pre approval letter expires before you can find a home, your lender may ask you to submit additional documents like recent bank statements and tax returns to get a new pre approval letter.

If there no changes to your financial situation, your lender will likely issue a new pre-approval with a new expiration date the same day of your reapplication.

Impact on Your Home Buying Process

An expired mortgage pre approval can significantly affect your ability to make competitive offers. Sellers and real estate agents prefer buyers with current pre approval letters as they demonstrate financial readiness and serious intent to purchase.

Required Documentation for Renewal

When your pre approval expires, you’ll typically need to provide:

- Recent pay stubs (usually last 30 days)

- Updated bank statements (last 60 days)

- Current employment verification

- Recent tax returns (if a new tax year has passed)

- Updated asset statements

- Social Security number for credit verification

Credit Check Implications

When you renew your mortgage pre approval, the lender usually needs to do another hard inquiry on your credit report. This type of check can cause a small, temporary drop in your credit score — usually just a few points. For most applicants, this effect is minor and goes away over time.

Timeline for Pre Approval Renewal

Renewing your mortgage pre-approval is often quicker than applying the first time. Since the lender already has most of your financial details, the process is more straightforward. As long as you are quick to provide any updated documents, most lenders can complete the renewal in about 3 to 7 business days.

Pre Approval vs Pre Qualification: Understanding the Difference

While both pre qualification and pre approval are considered mortgage eligibility screening, they have different meanings, levels, and purposes.

Getting pre qualified gives you a general estimate of how much you can borrow to buy a home. Getting pre approved requires a detailed verification step to provide a more accurate estimate of the loan amount you can borrow as well as the interest rates.

Mortgage Pre Qualification

Mortgage pre qualification is a quick initial step in the home-buying process that you can typically complete online within an hour. As mentioned, it gives you a general idea of how much you might be able to borrow based on the financial information you provide. Since this information isn’t checked or verified, pre-qualification doesn’t carry much weight with sellers.

Pre qualification characteristics:

- Based on unverified financial information

- Usually involves a soft credit check

- Quick process with immediate results

- Less reliable for budgeting purposes

- Not as competitive when making offers

Mortgage Pre Approval

The preapproval process involves thorough verification. It means a lender has reviewed your financial documents — like tax returns and bank statements — and pulled your credit report.

Because of this deeper review, a pre-approval letter shows sellers that you’re a qualified buyer with solid financing. It also gives you a clearer idea of how much you can actually afford.

Pre approval advantages:

- Verified financial information through documentation

- Hard credit check provides accurate credit assessment

- Stronger negotiating position with sellers

- More reliable for determining your budget

- Required by many real estate agents before showing homes

How to Extend or Renew Your Mortgage Pre Approval

Contact your lender right away to extend or renew your mortgage pre approval. Do it before your pre approval expires and quickly provide the updated documents. This keeps your approval current, so you’ll be ready to make an offer when the right home comes along.

Extension Options

If your pre-approval is about to expire and you’re still looking for a home, many lenders offer extensions. These are usually easy to request and only require a few updated documents, such as a recent pay stub or a new bank statement.

Full Renewal Process

If significant time has passed or your financial situation has changed, you may need a complete renewal. This process involves:

- Updated Application: Review and update your mortgage application

- Fresh Documentation: Provide current financial documents

- Credit Check: New hard inquiry on your credit report

- Verification: Employment and income verification

- New Letter: Receive updated preapproval letter with current terms

Best Practices for Maintaining Your Pre Approval

- Monitor expiration dates: Set calendar reminders 2 weeks before expiration

- Maintain financial stability: Avoid big purchases or new debt during your pre approval period

- Communicate changes: Inform your loan officer of any changes in employment status or financial situation

- Organize documents: Keep financial documents readily available for quick renewal

Strategic Timing for Your Mortgage Pre Approval

Mortgage pre approval is a time-sensitive document. Getting your pre approval letter at the right moment in your house-hunting journey can help close the deal, protect your credit, and save you from unnecessary hassles.

When to Apply for Pre Approval

The best time to get preapproved is when you’re ready to start looking at homes to buy. If you obtain your pre approval before you’re ready to bid, it could expire before you use it. But don’t go rushing to get a last minute pre approval either as you could miss out on securing your dream house.

Optimal timing strategy:

- Apply 30-45 days before serious house hunting

- Ensure you’re financially prepared for homeownership

- Have a realistic timeline for finding and purchasing a home

- Consider seasonal market factors in your area

Maximizing Your Pre Approval Value

To get the most from your mortgage pre approval:

- Shop with multiple lenders: Compare mortgage options and terms during the same 30-day window to minimize credit impact

- Understand your debt to income ratio: Know how this affects your borrowing capacity

- Prepare for the mortgage process: Organize all financial documents in advance

- Work with experienced professionals: Choose a reputable mortgage lender with strong local market knowledge

Tips for First Time Homebuyers Getting Pre Approved

The mortgage pre-approval process has fewer steps and requirements than a complete application.

Here’s how to get started.

Essential Steps Before Applying

Before starting the preapproval process, first time homebuyers should:

- Check your credit score and address any issues

- Calculate your debt to income ratio to understand your borrowing capacity

- Gather all required documents including W-2s, tax returns, and recent pay stubs

- Research mortgage options to understand different loan terms

- Determine a realistic budget you can comfortably afford

What to Expect During the Process

Getting pre approved can take 7-10 business days. Your lender will walk you through each step, initial application to issuing the letter.

Avoiding Common Mistakes

- Don’t make big purchases: Avoid major purchases or opening new credit lines during your pre approval period

- Maintain employment stability: Avoid changing jobs during the mortgage process if possible

- Keep financial documents current: Ensure all documentation remains valid throughout your home search

- Communicate with your lender: Report any changes in your financial situation immediately

Frequently Asked Questions About Mortgage Pre Approval

What is the Mortgage Pre-Approval Process?

Start by filling out a mortgage application. This includes sharing details about your income, job, savings, debts, and the type of home you want to buy. The lender will then review this information and run a credit check. If everything looks good, the lender may give you a pre-approval letter. The letter is usually valid for 60 to 90 days.

Can I get multiple pre approvals from different lenders?

Yes, you can apply with multiple mortgage lenders to compare mortgage rates and loan terms. To minimize the impact on your credit score, submit all applications within a 30-45 day window, as multiple hard inquiries for the same type of loan are typically counted as a single inquiry.

Will getting pre approved hurt my credit score?

Getting pre approved involves a hard credit pull, which may temporarily lower your credit score by a few points. However, the impact is minimal and temporary, and the benefits of having a preapproval letter far outweigh this small effect on your credit.

Can I make offers without a current pre approval letter?

While it’s possible to make offers without pre approval, sellers in competitive markets strongly prefer buyers with current preapproval letters. Having pre approval demonstrates you’re a serious buyer with verified financing capability.

What if my financial situation changes during my pre approval period?

If your employment status, income, or debt levels change significantly, contact your loan officer immediately. They can assess how these changes affect your pre approval and guide you through any necessary updates to your application.

How is pre approval different from final mortgage approval?

Pre approval is a conditional commitment based on your financial profile, while final mortgage approval occurs after you have a purchase contract and the property has been appraised. The underwriting process for final approval is more thorough and includes property-specific requirements.

Can my pre approval amount change when I renew?

Yes, your pre approval amount can change based on updates to your credit score, income, debt levels, or changes in interest rates. If your financial situation has improved, you might qualify for a larger loan amount.

Conclusion: Making the Most of Your Mortgage Pre Approval Timeline

Understanding how long your mortgage pre approval is good for helps you time your home buying process effectively. With most pre approval letters valid for 60 to 90 days, strategic timing ensures you’re ready to act quickly when you find the right home.

Remember that your preapproval letter is a powerful tool in competitive real estate markets. It demonstrates to sellers that you’re a qualified buyer with verified financing, giving you an advantage over other buyers who may not have current pre approval.

Whether you’re a first time homebuyer or experienced in the real estate market, working with a knowledgeable mortgage lender who understands the home buying process can make your journey smoother and more successful. Take time to compare mortgage options, understand your budget, and maintain financial stability throughout your pre approval period.

By following these guidelines and working with experienced professionals, you’ll be well-positioned to navigate the mortgage process and secure financing for your dream home purchase.