Owning a home comes with significant expenses, but it also provides valuable tax benefits that can reduce your taxable income and save you thousands of dollars annually. For homeowners in San Antonio and South Texas, understanding these tax deductions becomes even more crucial given our region’s property tax landscape and unique market conditions.

Tax deductions for homeowners can help offset some of the costs associated with property ownership, potentially leading to substantial savings. These deductions apply to mortgage-related expenses, home improvements and certain state and local tax payments. While many tax benefits remain consistent year over year, recent legislative changes could impact eligibility or deduction limits in 2025.

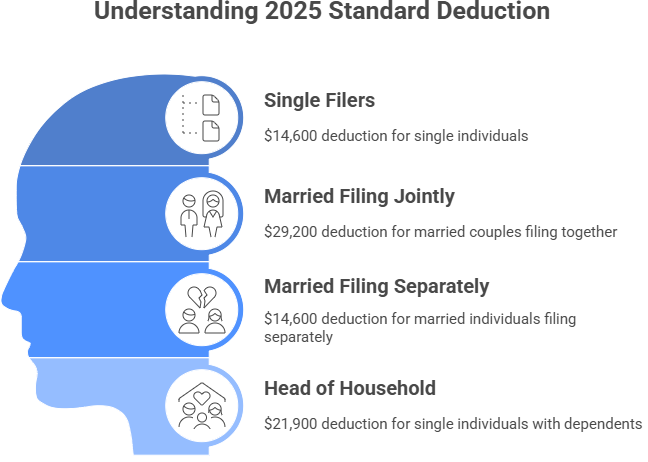

The key to maximizing your tax benefits lies in understanding whether to itemize deductions or take the standard deduction. For the 2024 tax year (filing in 2025), the standard deduction is $14,600 for single filers and $29,200 for married couples filing jointly. If your total itemized deductions exceed these amounts, itemizing could provide greater tax savings and significant tax benefits.

Understanding Tax Deductions for Homeowners vs. Standard Deduction

Before diving into specific homeowner tax deductions, it’s essential to understand the difference between itemized deductions and the standard deduction. Both types of deductions can lower your overall income tax burden by reducing your taxable income.

The standard deduction is a specific dollar amount that reduces the amount of income on which you’re taxed, based on your filing status. It’s available to all taxpayers regardless of their homeownership status and requires no additional documentation.

When you choose itemized deductions, you forgo the standard deduction and instead list individual tax-deductible expenses on Schedule A of Form 1040. This includes homeowner expenses like mortgage interest, property taxes, and other qualifying costs.

Texas Homeowner Advantage: Since Texas has no state income tax, homeowners can dedicate their entire state and local tax (SALT) deduction limit of $10,000 to property taxes alone, making itemizing more attractive for many San Antonio area homeowners.

Home Mortgage Interest Deduction: Your Biggest Tax Break

If you own a home and itemize your deductions, the mortgage interest deduction could be your biggest tax break. This deduction lets you lower your taxable income by the amount of interest you paid on your qualifying home loan during the year.

This means you might pay less in taxes just for paying interest on your mortgage — something you’re likely already doing if you’re a homeowner.

Current Mortgage Interest Deduction Limits

The amount of mortgage interest you can deduct depends on when you took out your mortgage loan:

For mortgages originated after December 15, 2017:

- You can deduct mortgage interest on up to $750,000 of mortgage debt ($375,000 if married filing separately)

- This limit applies to your primary residence and second home combined

For mortgages between October 14, 1987, and December 15, 2017:

- You can deduct interest on up to $1 million of mortgage debt ($500,000 if married filing separately)

For mortgages before October 13, 1987:

- You can deduct all mortgage interest with no limit

Your mortgage holder will send you Form 1098 each year showing the interest paid, making it easy to claim this deduction when filing your tax return.

Home Equity Loan Interest Deduction

You might be able to deduct the interest you pay on a home equity loan or a home equity line of credit (HELOC), but there’s an important rule to keep in mind. To qualify for the deduction, the money from the loan must be used to buy, build, or make significant improvements to the home that’s backing the loan.

This rule was introduced with the Tax Cuts and Jobs Act and is a key detail homeowners often overlook.

Key Rules for Home Equity Interest:

- Funds must be used for home improvements, not personal expenses

- Combined mortgage debt (primary mortgage plus home equity) cannot exceed $750,000 for the interest to be deductible

- Interest on home equity used for debt consolidation or other personal expenses is not deductible

South Texas Market Insight: With rising home values in San Antonio, many homeowners have built substantial equity. If you’re considering a home equity loan for renovations, the tax benefits can make these improvements even more financially attractive.

Property Tax Deduction: Navigating the SALT Cap

For many San Antonio homeowners, property taxes are a big yearly expense, but they can also offer some relief at tax time. The IRS allows you to deduct property taxes on your federal return, but there’s a catch.

This deduction is part of what’s called the SALT cap (short for state and local taxes). Under this rule, the total amount you can deduct for all state and local taxes — including property taxes — is limited to $10,000 per year, or $5,000 if you’re married and filing separately.

Texas Property Tax Advantage

Texas homeowners have a unique advantage when it comes to the SALT deduction. Since Texas has no state income tax, homeowners can use the full $10,000 SALT deduction for property taxes, unlike residents of other states who must split this limit between property taxes and state income taxes.

San Antonio Property Tax Landscape:

- Effective property tax rate: Approximately 2.35%

- For a $300,000 home: About $7,050 in annual property taxes

- Well within the $10,000 federal deduction limit for most homeowners

Bexar County Property Tax Components

Understanding your property tax bill helps maximize your deductions:

- School District taxes: Largest component of your tax bill

- City of San Antonio: Municipal services and infrastructure

- Bexar County: County-wide services

- Special districts: May include emergency services, hospital districts

Texas Homestead Exemptions

While these exemptions reduce what you pay locally, you can still deduct the full amount you actually paid up to the federal $10,000 limit:

Available Exemptions:

- General Homestead: $100,000 school district exemption, plus up to 20% local exemptions

- Over-65 or Disabled: Additional $10,000 exemption with tax freeze provisions

- Disabled Veterans: Varies based on disability rating, up to 100% exemption

Additional Tax Deductions and Credits for Homeowners

While mortgage interest and property taxes get most of the attention, there are a few other home-related expenses that can help lower your tax bill if you itemize. These include:

Mortgage Discount Points

Discount points are fees paid to lenders at closing for the purpose of reducing a loan’s interest rate. One discount point typically costs 1% of the mortgage amount and reduces your rate by approximately 0.25%.

Deduction Rules:

- New home purchase: Points paid on a home purchase loan are fully deductible in the year of payment if they meet IRS requirements

- Refinancing: Points must generally be deducted over the life of the loan rather than all at once

Requirements for full deduction:

- The loan was used to purchase or build your main home

- Paying points is a common business practice in your area

- The amount paid is typical for your area

- You didn’t borrow money from your lender to pay the points

Home Office Deduction for Self-Employed Homeowners

With the rise of remote work, many San Antonio homeowners qualify for home office expenses deductions. However, this deduction is only available to self-employed individuals who use part of their home exclusively and regularly for business purposes.

Two calculation methods:

- Simplified method: Deduct $5 per square foot of home office space, up to 300 square feet (maximum $1,500)

- Actual expense method: Deduct the percentage of actual home expenses (utilities, insurance, depreciation) based on office space

Important note: Regular employees working from home cannot claim home office expenses under current tax law.

Energy Efficiency Tax Credits

The federal government offers tax credits (not deductions) for energy-efficient home improvements. Credits reduce your tax liability dollar-for-dollar, making them more valuable than deductions.

2025 Energy Efficiency Credits:

- Heat pumps and biomass systems: 30% of cost up to $2,000 annually

- Home energy audits: 30% of cost up to $150

- Insulation and air sealing: 30% of cost up to $1,200

- Windows and doors: 30% of cost with specific limits ($600 for windows, $250 per door)

Residential Clean Energy Credit: 30% credit for solar panels, wind turbines, and geothermal heat pumps through 2032.

Medical Home Improvements

Certain medically necessary home improvements may qualify as medical expense deductions if they exceed 7.5% of your adjusted gross income. Examples include installing wheelchair ramps, widening doorways, or adding stairlifts.

The amount you can deduct depends on whether the home improvement increases your property value. If the improvement doesn’t increase value, the full cost may be deductible. If it does increase value, only the amount exceeding the value increase is deductible.

What Homeowners Cannot Deduct: Common Misconceptions

It’s just as important to know what isn’t deductible. Many people assume they can write off things like home insurance, utility bills, or the routine maintenance cost, but unfortunately, those expenses don’t qualify for a tax break.

When you know what doesn’t count, you’ll avoid mistakes on your return and have a more realistic idea of your tax savings.

Non-Deductible Homeownership Expenses

The Internal Revenue Service specifies several homeowner expenses that are not tax-deductible:

Insurance and Protection:

- Homeowners insurance premiums

- Fire insurance premiums

- Title insurance

- Private mortgage insurance (PMI) premiums (after 2021)

Loan Payments and Fees:

- Principal payments on your mortgage payment

- Loan origination points (fees that don’t reduce interest rates)

- Most closing costs and settlement fees

Maintenance and Operations:

- Homeowners association fees and condominium association fees

- Utilities like electricity, water, and gas

- Home repairs and routine maintenance

- Landscaping and lawn care

- Wages paid to domestic help

Other Non-Deductible Costs:

- Home depreciation on your primary residence

- Forfeited deposits and earnest money

- HOA assessments for improvements

Special Considerations for Investment Properties

Different rules apply to rental properties, which are treated as business expenses rather than personal homeowner deductions. These expenses are reported on Schedule E rather than Schedule A.

How to Claim Tax Deductions for Homeowners

If you want to take advantage of homeowner tax breaks, you’ll need to itemize your deductions instead of choosing the standard deduction. Here’s how to get the most from your homeowner tax benefits:

Step 1: Gather Required Documentation

Essential records to maintain:

- Form 1098: Mortgage Interest Statement from your lender

- Property tax bills and payment receipts

- Closing statements showing discount points paid

- Home equity loan documentation

- Receipts for qualifying home improvements

- Energy efficiency upgrade receipts and manufacturer certifications

Step 2: Calculate Your Total Itemized Deductions

Add up all qualifying deductions:

- Mortgage interest paid during the tax year

- Property taxes actually paid (up to $10,000 SALT limit)

- State and local income taxes or sales taxes (combined with property taxes, cannot exceed $10,000)

- Other itemized deductions (charitable contributions, medical expenses exceeding 7.5% of AGI)

Step 3: Compare to Standard Deduction

Only itemize if your total exceeds the standard deduction for your filing status. For many San Antonio homeowners with mortgages, the combination of mortgage interest and property taxes alone often exceeds the standard deduction threshold.

Step 4: Complete Schedule A

Report your homeowner deductions on Schedule A (Form 1040):

- Line 8a: Home mortgage interest and points

- Line 5b: State and local property taxes (limited to $10,000)

- Home office expenses: Report on Form 8829 if self-employed

Step 5: Consider Professional Help

Given the complexity of tax laws and the significant savings potential, consider working with a qualified tax preparer familiar with homeowner deductions and Texas property tax laws.

Strategic Tax Planning for San Antonio Homeowners

Timing Your Deductions

Property taxes are deductible in the year you actually pay them, not when they’re assessed. This creates opportunities for tax planning:

December Property Tax Strategy: Some homeowners pay their January property tax bill in December to accelerate the deduction into the current tax year, particularly beneficial in years when you’re close to the itemizing threshold.

Home Improvement Timing: Coordinate energy-efficient improvements to maximize available tax credits while staying within annual limits.

Multi-Year Planning

Consider spreading major home improvements across multiple tax years to optimize credit utilization and avoid hitting annual caps on energy efficiency credits.

Record Keeping Best Practices

Maintain organized records of all homeowner expenses. South Texas Lending recommends creating a dedicated file for tax-related homeownership documents from closing day forward. Digital copies of receipts and statements can prevent lost documentation.

Local Benefits: Texas-Specific Homeowner Advantages

Mortgage Credit Certificates (MCCs)

First-time home buyers in Texas can apply for a Mortgage Credit Certificate through the Texas State Affordable Housing Corporation. This program provides a tax credit (not deduction) of up to $2,000 annually on mortgage interest paid.

MCC Benefits:

- 15% of annual mortgage interest as a tax credit

- Available for the life of the mortgage

- You don’t need to itemize to receive this credit

- Particularly valuable with higher interest rates

Property Tax Protest Process

Texas homeowners can protest their property tax valuations, potentially reducing both local taxes owed and maintaining federal deduction benefits on the amounts actually paid.

Protest deadlines: Generally by May 15th annually through the Bexar Appraisal District for San Antonio homeowners.

Frequently Asked Questions

Answer: No, homeowners association fees are not tax-deductible for personal residences because they’re imposed by private associations, not government entities.

Answer: Homestead exemptions reduce your local property tax burden, but you can still deduct the full amount you actually pay (up to the $10,000 federal SALT limit) on your federal tax return.

Answer: Regular home improvements are not immediately deductible, but they may increase your home’s cost basis for future capital gains calculations. However, medically necessary improvements and energy-efficient upgrades may qualify for current-year deductions or credits.

Answer: You can only deduct property taxes actually paid to the tax authority during the tax year, not amounts deposited into escrow. Your Form 1098 mortgage statement will show the actual amounts paid.

Answer: Itemize if your total deductions exceed the standard deduction ($14,600 for single filers, $29,200 for married filing jointly in 2025). Most San Antonio homeowners with mortgages benefit from itemizing due to high property taxes and mortgage interest.

About South Texas Lending: As San Antonio’s trusted mortgage professionals, we help homeowners understand the complete financial picture of homeownership, including tax implications. Our local expertise in the South Texas market means we understand both the opportunities and challenges facing area homeowners.

Ready to explore homeownership in San Antonio? Contact South Texas Lending at (210) 750-6461 to discuss how current tax benefits can impact your home buying or refinancing decision. Our experienced loan officers understand the local market and can help you maximize the financial benefits of homeownership in Texas.